How to Prepare for Inflation with Hard Assets, Inflation Stocks and Smart Inflation Hedging Strategies

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” Ronald Reagan

According to government figures, inflation is inching upwards. When you go to the supermarket, your grocery bill is trending up! At the gas station, prices are also expanding. Fortunately, there are ways to handle and prepare for inflation.

Find out what causes inflation to rise, how to prepare for inflation and why you must do so now.

Contents

- How to Prepare for Inflation with Hard Assets, Inflation Stocks and Smart Inflation Hedging Strategies

- Unanticipated Inflation Can Cost You – Learn Why

- Making Sense of the CPI

- How to Prepare for Inflation – 8 Tips + a Bonus

- 1. What to stock up on before inflation?

- 2. If you’re thinking of buying a home or a car, you’re better off taking on the debt when rates are lower, rather than waiting until they rise along with inflation.

- 3. Gold might be a good inflation hedge.

- 4. The best investments during inflation include stocks that will benefit from rising prices.

- 5. The best investments during inflation include inflation protected government securities, step up notes, and CD ladders.

- 6. Keep investing in the stock market, regardless of the economic scenario.

- 7. Real estate investing is a hard asset that’s easy to invest in.

- 8. Take a look at commodity funds.

- 9. Retirees wondering what to do during inflation, consider waiting to take your Social Security pension.

- FAQ

- How to Prepare for Inflation Wrap Up

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Unanticipated Inflation Can Cost You – Learn Why

What causes inflation?

Economists use the term inflation to describe a situation in which too much money is chasing too few goods and services. The more money the government prints, the less your dollar is worth.

The main causes of inflation are:

- The economy is growing too quickly and there is greater demand for goods and services, than there is supply.

- The government increases the money supply, so the dollar is worth less, due to a greater supply of money in the economy.

- Higher wages, which increase firms costs and consumers disposable income, thereby boosting demand and driving up prices.

- This leads to each dollar being less valuable than before and purchasing fewer goods and services than in the past.

We may find that as a result of the Corona Virus pandemic, the country will ramp up U.S. manufacturing of previously outsourced goods. This could place upward pressure on inflation as manufacturing costs are typically higher in the U.S. than in many foreign countries. Higher manufacturing costs will ultimately lead to higher prices.

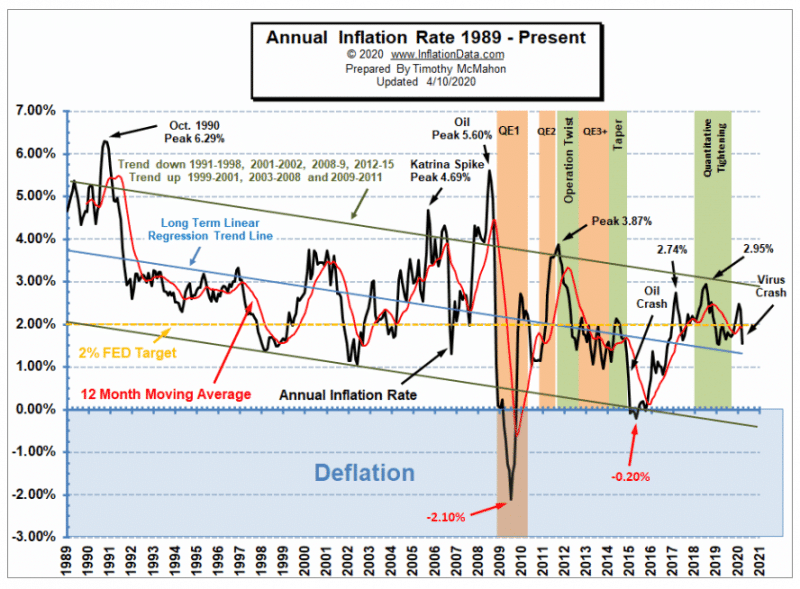

According to Lawrence H. White at econlib.org, inflation rates since 1950, as measured by the Consumer Price Index (CPI), ranged from -0.7% in 1954 to a high of 13.3% in 1979. Although since 1991, the inflation rate has remained relatively constant, between 1.6% and 3.3% per year.

Using the latest US government CPI data from usinflationcalculator.com, an item that cost $100 in 1980 would cost $344 in 2022. While great, if you own your own home, the exploding inflation rates are concerning if you drive and eat with soaring gas and food prices.

The most commonly cited measure of inflation in the United states is the CPI. It’s a measure that calculates the weighted average prices of a basket of consumer goods like transportation, food, medical care, education, recreation and more.

According to the Bureau of Labor statistics, the Consumer Price Index for All Urban Consumers increased 7.9 percent over the 12 months from February 2021 to March 2022. This is the largest inflation increase since September 2008.

So, what does all this mean for you and your money, right now?

Preparing for inflation is kind of like taking out financial insurance. Even if you experience a small amount of inflation now, inflation is likely to increase in the future. The time to create a hedge against inflation, is now! The Corona Virus pandemic teaches us the importance of advance preparation.

The secret to getting rich {without winning the lottery}-click here.

Making Sense of the CPI

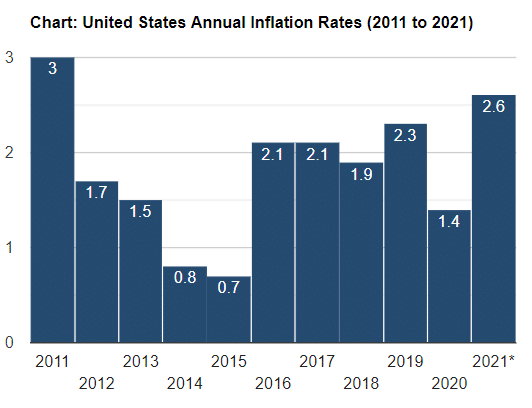

As of March, 2021, the Consumer Price Index is approximately 2.5%. That is up, 2.6% since March, 2020. Given this information, consumers are smart to prepare for inflation and consider what to stock up on before inflation.

The CPI is based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’

Bureau of Labor Statistics – https://www.bls.gov/news.release/pdf/cpi.pdf

services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected

each month in 75 urban areas across the country from about 6,000 housing units and approximately

22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types

of stores and service establishments).

The Consumer Price Index is the most common measure of inflation. It can be calculated several ways. One way includes food and energy costs, the other doesn’t. I prefer the CPI that includes food and energy, after all, we all eat and use energy! Ninety-three percent of the CPI reflects urban consumers, the other 7% reflects rural populations, military, the incarcerated, and hospitalized populations.

Annual inflation rates are calculated with 12-month data of the Bureau of Labor Statistics Consumer Price Index (CPI).

The CPI covers goods and services from these categories:

- Food and beverages

- Housing

- Apparel

- Transportation

- Medical care

- Recreation

- Education and Communication

- Other

What is Your Personal Inflation Rate?

Before we get into inflation hedges and protection strategies, understand your personal inflation rate.

Inflation is personal. If you don’t drive and live in a warm climate, then the oil prices don’t matter. If you are single and don’t eat much, then food prices aren’t a big deal. Whereas if you live in NYC, don’t drive and have 4 teenagers, then rent and food inflation will be steep.

Although the published inflation rates are informative, they don’t always apply to your situation.

Ultimately, if you are over age 50, own your own home, aren’t paying for education and have low medical expenses, then you will be less impacted by inflation than someone who consumes from more of the CPI categories.

Unanticipated inflation occurs when the items and services that you consume most frequently increase, and your income doesn’t keep pace.

So, take the published inflation rates with a grain of salt. What you buy and the services that you use, will directly influence your own personal inflation rate.

A Little Inflation Goes a Long Way

You must prepare for inflation, despite the advantages of inflation.

Famous British economist, John Maynard Keynes, promoted moderate inflation to prevent the “paradox of thrift.” If prices fall too much, because the country is becoming too productive, then consumers will slow spending, expecting that if they wait, they’ll snare a better deal. This leads to lower demand, production, layoffs and a declining economy.

Also, with inflation, debtors benefit as they’re repaying loans with money that’s worth less than the dollars that they borrowed. Inflation also helps the Federal Reserve repay it’s massive debt with cheaper dollars.

How to Cope with Rising Inflation? Outsmart it and prepare for inflation.

And who doesn’t like wage inflation, when your salary increases? As long as it’s rising more quickly than your costs are growing, you’re in good shape.

So, some inflation is okay, but watch out, because the negative correlation between interest rates and inflation suggest that if low interest rates continue, in time inflation will ramp up.

chart source; usinflationcalculator.com

How to Prepare for Inflation – 8 Tips + a Bonus

It’s not too late to hedge against inflation.

1. What to stock up on before inflation?

Inflation means rising prices, so stock up now on non-perishables, or items that keep for awhile.

When I was a little girl, my mom bought huge amounts of toilet paper, canned goods, and other non-perishable items on sale and stored them in the basement. Although it was annoying to hunt down a roll of toilet paper in the basement, now I totally get it. During times with increasing inflation, buying large quantities on sale was a true inflation hedge!

Grab the loss leaders (the items that store’s price at cost to lure you in).

Don’t forget the towels and sheets during the annual January white sale. At the end of the season, mark downs are the greatest. And get electronics near the holidays.

2. If you’re thinking of buying a home or a car, you’re better off taking on the debt when rates are lower, rather than waiting until they rise along with inflation.

Prepare for inflation with responsible borrowing.

Consider refinancing your home when interest rates are low and lock in a low fixed rate mortgage. Taking out a 15 year loan can substantially reduce your total interest payments. Just beware of adding to the length of the loan.

With increasing inflation, you’ll also end up paying off the debt with cheaper future investment dollars.

This doesn’t mean max out your credit cards, that’s rarely a good idea, especially as credit card interest rates are relatively high.

3. Gold might be a good inflation hedge.

Although gold doesn’t pay dividends, it is widely considered a sound store of value. From historical times, gold has been revered.

Gold is older than today’s prominent global currencies like the Euro and the US dollar. In fact, gold has preserved wealth for thousands of years. Additionally, gold is less correlated with common asset classes like stocks and bonds. Although there are periods where gold underperforms the stock markets, many like to own a percent of their assets in either gold coins, ETFs or other types of gold assets.

4. The best investments during inflation include stocks that will benefit from rising prices.

As professionals whisper across the internet that we may be in for unanticipated inflation, consider picking inflation stocks from sectors that typically do well during inflationary times:

- Commodities – Tangible assets have been inflation hedges in the past.

- Real Estate – This inflation hedge will profit from both rising rent payments and appreciation as the property increases in value.

- Hard assets – Gold, silver, platinum and other metals provide a hedge against inflation.

- Materials Companies – The materials sector includes many types of manufacturers including steel, chemical, glass, paper, forest products, mining and more.

- Industrial and Transportation Companies – Transportation companies include airlines, railroads, shipping, and logistics while industrial firms provide products and services for the construction and manufacturing industries.

- Small Caps – These smaller firms are leaner and may profit from rising prices.

- Foreign Companies – Many foreign firms are involved in the industrial and commodities sectors.

- Commodities – Tangible assets have been inflation hedges in the past.

- Real Estate – This inflation hedge will profit from both rising rent payments and appreciation as the property increases in value.

- Hard assets – Gold, silver, platinum and other metals provide a hedge against inflation.

- Materials Companies – The materials sector includes many types of manufacturers including steel, chemical, glass, paper, forest products, mining and more.

- Industrial and Transportation Companies – Transportation companies include airlines, railroads, shipping, and logistics while industrial firms provide products and services for the construction and manufacturing industries.

- Small Caps – These smaller firms are leaner and may profit from rising prices.

- Foreign Companies – Many foreign firms are involved in the industrial and commodities sectors.

5. The best investments during inflation include inflation protected government securities, step up notes, and CD ladders.

Look at Government inflation protected bonds such as TIPS and I Bonds. These government offerings are a great tool for protecting your capital against inflation.

Although you typically don’t receive capital appreciation by investing in TIPS and government I Bonds, treasury protected securities increase their payouts or principal based upon the rate of inflation.

That means that your purchasing power will increase along with rising inflation.

Another inflation investment to consider is the step up note. These bonds increase their dividend payments at pre-determined intervals.

CD ladders are a great inflation hedge as well during periods of rising interest rates. Buy CDs, with varying maturities. When one CD comes due, invest the proceeds in a higher yielding CD.

6. Keep investing in the stock market, regardless of the economic scenario.

If history is any guide, the longer your money remains invested, the greater average annual returns you can expect from your stock and bond investments. Keep your investing plan in place during inflationary periods.

When demand for goods and services increase, companies have room to raise prices.

As long as wages and costs rise at a lower rate than prices, corporate profits will increase and subsequently, so will stock prices.

Click now to get a low cost plan to cut investment fees to the bone and manage your own investments.

7. Real estate investing is a hard asset that’s easy to invest in.

When inflation hits, real estate prices usually rise as well. The opportunities for small and large investors to invest in real estate continues to grow. There are so many ways to invest in real estate:

- Real estate crowdfunding

- Buying real estate outright and either renting or fixing up and flipping

- Investing in real estate investment trusts or REITs

Diversyfund offers a range of real estate investing options. Visit their website to learn more.

8. Take a look at commodity funds.

In his Forbes.com article, “7 Ways to Beat Inflation”, William Baldwin suggests investing in companies that “…dig stuff out of the ground. The T. Rowe Price New Era Fund has delivered handsome returns over the past decade by owning resource sector companies like Schlumberger, Cameron International and Freeport-McMoran Copper & Gold. This fund charges a fee of 0.67% of assets annually.”

You may want to look at precious metals and energy ETFs as well.

9. Retirees wondering what to do during inflation, consider waiting to take your Social Security pension.

If you can hold off until age 70, you’ll lock in your largest monthly benefit. Your monthly Social Security check will be 24% larger at age 70 than if you began taking payments at age 67.

Conversely, if you start early, your benefit might be reduced as much as 30%.

Since your Social Security annuity is inflation protected the larger benefit that you receive at age 70 will continue to increase at the rate of inflation, throughout your life.

FAQ

Stock up on consumables when there are sales. Switch to lower cost substitutes when shopping for necessities, like generic brand groceries, and meat-free meals like pasta. Adjust your lifestyle to spend less. Ask your boss for a raise, as the labor shortage makes employers more likely to keep existing employees happy. Prepare mentally by realizing that high prices are usually time limited and will revert to more realistic levels, over time.

Stocks in companies that can easily raise prices will do well in inflation. Gold and commodities tend to do well during inflation. Here’s an easy way to invest in Gold. Real estate also does well during inflationary times. Check out REITs and real estate crowdfunding.

How to Prepare for Inflation Wrap Up

When wondering How to Prepare for Inflation, remember to start planning early.

Consider the impact of inflation when spending and investing.

Buy in bulk, when you can.

Take advantage of Government inflation protected securities.

Investing can be a sound inflation hedge. Consider adding real estate to your portfolio. Finally, stock up on staples when prices are low. During times of low inflation, its wise to prepare as unanticipated inflation may crop up when you least expect it.

New and experienced investors will appreciate the free M1 Finance investment platform. You get fee-free stock and fund trading as well as cash management, lending and automated portfolio rebalancing. Check it out now!

Related Inflation Investments Articles

- Equity Multiple Review – Real Estate Crowdfunding

- Accredited Investor Opportunities

- FarmTogether vs Acretrader – Which Farm Investing Platform is Best for you

- Fundrise vs Diversyfund vs Groundfloor | Real Estate Crowdfunding for All

- Pros And Cons Of Investing In Inflation

- What Are TIPS Inflation Bonds?

- Vaulted Review-Physical Gold Investment App

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

6 thoughts on “How to Prepare for Inflation – 8 Actionable Tips”

O am 73 with lung cancer, wife of 50 years is 71. Own rentals and two homes Al free and clear.

$ in bank

I was thinking of gold & silver?

You thoughts

Hi J, First off, congratulations with rentals and $$ in the bank. I cannot provide investment advice but here are my thoughts. You’ll of course need to speak with your own advisor for financial information, as he or she will be familiar with your financial situation. Gold and silver are stores of value and don’t pay any dividends. If you want to preserve your wealth against inflation, I prefer I bonds and TIPS. You can learn more about these investments at https://www.treasurydirect.gov/. You can also invest in “TIPs” exchange traded funds which are bought through a brokerage account. Here are a few articles on the topic: https://barbarafriedbergpersonalfinance.com/tips-bond-inflation/, https://barbarafriedbergpersonalfinance.com/here-is-a-guaranteed-way-for-your-money-to-keep-pace-with-inflation-part-1/

Very helpful information.

As an editing note, in the second sentence of no. 1, there is a semi-colon where there should be a comma.

Hi Old Professor, Glad you liked the article. I thank you, and so does my Mother, who was a former English teacher :). Thanks for reading, Barbara

The first portion of your comment is not a complete sentence, Old Professor. Why is there a period?

Great post, really insightful.I have to share this because I myself struggled with debt for a long time until I learnt a couple of things from this guy that was literally the game changer for me, highly recommend! also doesnt matter what kind of debt it is this guy has the solution, with the stuff I learnt I wont be getting into debt anytime soon! http://forgetalldebts.com/