The one thing that nearly every successful person does is properly manage their finances. To help you make the best financial management software choice, read this Quicken vs. Empower (formerly Personal Capital vs Quicken) review. You’ll get an in depth look at the features of the free Empower Dashboard and the paid Quicken program, along with pros and cons of both.

I’ve used Quicken for decades and Empower for 8+ years. When I was introduced to Empower (Personal Capital), I quickly, linked up my accounts and was impressed with the free investment, retirement, and cash flow features.

I continue to use both Quicken and the free Empower (Personal Capital) reports and money management tools.

It’s important that the financial management software program you choose can accommodate your accounting needs and expectations so read this Quicken vs Empower comparison to decide which one (or both) is for you.

Contents

- What is Quicken?

- What is Empower?

- Quicken vs. Empower – Uploading Data

- Quicken vs. Empower – Dashboard Home Screen

- Quicken vs. Empower – Apps Flexibility / User-Friendliness

- Quicken vs. Empower -Investment Tracking

- Quicken vs. Empower – Advice and Planning

- Quicken vs. Empower – Budgeting

- Quicken vs. Empower – Fees

- Quicken vs. Empower – Security

- Quicken vs. Empower – Customer Service

- FAQ

- Quicken vs. Empower – Final Wrap up

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is Quicken?

Quicken is money management software that’s been around for 30+ years. This Quicken comparison uncovers the range of budgeting, cash flow, debt, investment, bill pay and planning features.

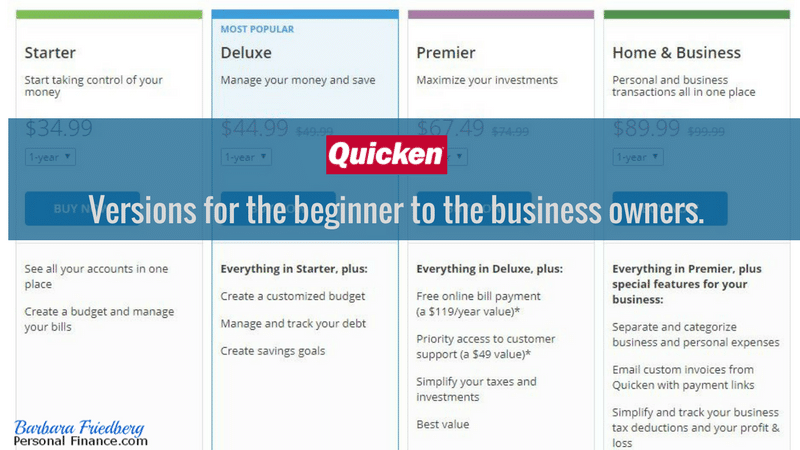

Quicken has various plans and charges an annual subscription fee.

Here’s what Quicken offers:

- Banking, credit card, investment, and debt tracking.

- Scores of customizable reports

- Free credit monitoring

- Budgeting

- Retirement planning

- Small business and real estate tracking

- Bill pay

What is Empower?

Empower is actually two services. The first is outstanding FREE money, retirement and investment management reports, tracking, and planning tools.

While Empower Advisors is a financial planning and investment management service. The Empower Wealth Management platform is a comprehensive planning firm with financial advisors, cash management and digital investment management.

This review will focus on the free Empower Money Management tools including:

- Net worth tracker

- Savings planner

- Budgeting tools

- Cash flow management

- Retirement planner

- Education planner

- Investment check up

- Fee analyzer

Quicken vs. Empower – Uploading Data

Winner: It’s a tie.

Although Empower used to be the winner in this category, Quicken has improved it’s capacity to link all accounts. At both Empower and Quicken linking and syncing accounts is fast and accurate.

Due to security upgrades, both platforms might request you to reconnect a financial account. Although it’s added effort, it’s worth the financial information protection.

Quicken vs. Empower – Dashboard Home Screen

Winner: Quicken

Quicken inched out Empower with customizable tiles and broader options. While, both the Quicken and Empower dashboard’s show all account listings on the dashboard. That includes bank, investment, credit card, debt and asset (like your home) values. The Quicken dashboard covers:

- Investment Top Movers

- Portfolio

- Bills, income and transfers

- Net worth

- Income and Expense graph

- Top Spending categories

- Top payees and recent transactions

Quicken users can customize the time period for each category and encompasses spending, saving and investing details.

But don’t count Empower out. The account values are automatically updated on Empower, while on Quicken, to get current account values, you need to click the “update” icon.

Both platforms show your net worth figure, although Empower also shows a 90-day net worth graph. While the time period is adjustable on Quicken

Both platforms show cash flow information – monthly income vs. expenses.

Both platforms show 30-day spending by account.

Next, several instances where the dashboards vary.

Empower Dashboard Information:

- Graphs cash balances

- Graphs 90-day investment portfolio growth

- Graphs retirement savings

- Graphs monthly emergency fund amount

- Compares your investment returns – You Index – with those of major market indexes in market movers section.

Quicken Dashboard Information:

- Bills and income reminders

- Top Spending Categories

- Budgeting data is accessed from the budget that you input. You can customize to show budget categories vs. actual spending.

- Calendar view of income and expenses.

Quicken’s dashboard is more comprehensive on the spending and budgeting items, while Empower focuses heavily on investment-related data. We especially like the “You Index” that compares your returns with major benchmarks.

Quicken vs. Empower – Apps Flexibility / User-Friendliness

Winner: It’s a tie.

Both programs have their mobile application counterparts that will let you access your financial information on the go. While Quicken sends user control alerts, Empower gives real time financial updates.

The Empower budgeting app vs the Quicken app is a tough comparison. If you’re seeking basic budgeting help, then Simplifi by Quicken might be your best choice. As previously mentioned, for customization and basic budgeting, Quicken and Simplifi will better suit your needs than Empower.

Quicken vs. Empower -Investment Tracking

Winner: It’s a tie.

Empower is better at automatic updating of accounts. Empower investment tracking is quite good.

After signing up for Empower you gain access to the following investing-related reports:

- Net Worth and Account Balances

- Cash Flow Analysis

- Investment Returns

- Asset Allocation View

- Retirement Fee Analyzer

- Investment Check-up

- Withdrawal Planner

With Empower you receive a picture of your current financial situation, help managing your investments and how your investing can be improved. Even if you choose Quicken, you might consider signing up for Empower, as well.

Quicken offers more reports and the ability to customize those documents. Although, after pushing the “icon” to update accounts, Quicken investment tracking is quite good. And the customizable Quicken investment tracking reports are excellent. Each report is customizable by asset. account, time period, and more.

For example, in Quicken you can create specific tax reports for various time periods. You can also create reports to compare your spending with various times and other metrics. Quicken is more cumbersome when it comes to tracking investment values. The lack of an automatic investment value feature means that you need to manually update asset values.

Quicken investment tracking reports:

- Asset Allocation

- Investment income

- Investment Performance

- Investment Transactions

- Investment Values vs. Cost Basis

- Internal Rate of Return

- Activity

- Income by Security

- and more

Quicken vs. Empower – Advice and Planning

Winner: Empower

For a fee, Empower Advisors provides access to Certified Financial Planners and wealth management.

Empower’s free tools offer investment fee analysis and a comprehensive investment checkup. While Quicken offers in-depth debt management.

Link $100k or more in investable assets and talk to a financial advisor about your goals. Receive a free personalized financial plan that’s yours to keep.

Both, Quicken and Empower offer Retirement planning tools:

- Empower analyzes your portfolio and determines how you’re set up for retirement. You get a likelihood of reaching retirement financial goals along with planning tools and recommendations.

- Quicken has a “Lifetime Planner” that allows you to input data and determine how various scenarios will affect your ultimate retirement. This feature includes income, tax rate, inflation, savings, investments, and expenses details.

- Quicken’s planner feature is more interactive than Empower’s retirement planner.

OnTrajectory also offers in depth retirement planning tools as well.

Investment Check up – Empower analyzes your portfolio and makes investment recommendations. The analysis of my personal portfolio showed that it was too conservative. Empower made specific investment recommendations.

Fee Analysis – Empower analyzes your investment fees and compares them to an average benchmark. Quicken lacks this feature.

Savings Goals – Quicken helps you save for future goals such as a summer vacation or college and “hides” these funds from view.

Debt Reduction – Quicken has a Debt Reduction Planner to help you create a plan to eliminate debt. Empower does not.

Quicken Financial Planner – This in depth online financial planner is a tool to help you create your own financial plan. The Quicken financial planner considers your personal situation, income, tax rate, expected inflation, projected saving and investing, assets, liabilities and expenses. You can change the assumptions, explore what if scenarios, and determine whether you’re on track to meet your retirement goals and other financial goals.

Quicken vs. Empower – Budgeting

Winner: Quicken is better suited to budgeting than Empower.

Quicken allows you to create a budget by category and compares your actual income and expenses with your budget.

Tracking Income and Expenses

Both platforms provide views of income and expenses.

Empower allows you to view income vs. expenses, but doesn’t have a feature to create a budget.

In Quicken you can create and assign budget categories, but not with Empower.

In Quicken you can also view reports and income by categories. This is very handy if you’re running a small business or at tax time.

These are Empower’s Budget Reports:

- Cash Flow Analysis

- Income Report

- Spending Report

These are Quicken’s Budget Reports:

- Current or Historical Budget or Graph

- Itemized Categories

- Itemized Payees

- Spending by Category – Report or Graph

- Spending by Payee – Report or Graph

- Current Spending vs. Average Spending by Category and Payee – Report or Graph

- Current Income and Expense by Category and Payee – Report or Graph

Those with a basic financial picture, seeking a budgeting app might prefer Quicken Simplifi.

Try Simplifi by Quicken! Get it now for as little as $3.99/month!

Quicken vs. Empower – Fees

Winner: Empower

The Empower Dashboard and reports are free. So, there is every reason to sign up, link your accounts and make use of their features. The “cost” of using Empower is that if your assets are more than $100,000, you might need to field a call from an Empower team member.

I use both Empower and Quicken. Quicken is invaluable for the customizability of of report categories as well as customizable spending, expense, and tax reports. If you have more than the simplest financial situation, we suggest paying up for Quicken and using the FREE Empower tools as well.

Quicken has several versions as well as a subscription model. The Starter Quicken option is replaced by the Simplifi by Quicken budgeting and money management app.

Try Simplifi by Quicken! Get it now for as little as $3.99/month!

Quicken vs. Empower – Security

Winner: It is a tie. Both have high level security.

Quicken is a desktop and app-based program. Information is stored locally, although you have the option to upload it to the cloud. I personally have a dedicated desktop computer upon which I store my Quicken data and don’t use the cloud option. I also don’t access Quicken from my laptop or phone.

Quicken has 256-bit encryption to protect data transfer from your financial institution. There’s also a “password vault” that protects your institutional passwords.

Empower requires two factor authentication to enter the site. The data is encrypted with military grade AES-256. Employees don’t have access to any password type information.

Finally, both sites have vigorous firewalls to protect their servers.

Quicken vs. Empower – Customer Service

Winner: It is a tie.

Both Empower and Quicken offer decent customer service options.

Quicken has an active forum and a detailed FAQ page. Quicken also has live chat. There is als phone support from 5:00 AM to 5:00 PM Pacific time. For an extra fee, you can purchase premium phone support. I’ve had successful customer service phone calls with Quicken reps.

Empower offers technical help from the “help” icon on the bottom right corner of the screen. You can also contact the firm via email and phone. Although, the premium Empower Advisors wealth management will have access to Financial Advisors for investment related questions.

Read: Empower Review

FAQ

The best alternative to Quicken for free investment tracking, money management and retirement planning might be Empower. Also, you might check out your bank or financial firm to find out what type of budgeting and financial tracking tools they offer. There are several Quicken alternatives at various price points, providing a range of personal finance tracking tools. Simplifi by Quicken is a slimmed down, and lower cost Quicken alternative. Tiller is a spreadsheet-based budgeting and money management tool. CountDown can import Quicken data and has a lot of similarities with the Quicken platform, but at lower price points.

No, that’s one of the disadvantages of Empower. Quicken does allow account reconciling. Quicken also offers bill pay.

Mint is being discontinued and integrating with Credit Karma. Currently, Empower is the only free budgeting, saving, retirement planning investment manager with both a website and app that we are aware of. Quicken is good for customizable spending, saving, budgeting and investment tracking and reports. Quicken Simplifi is excellent for budgeting and investment tracking.

If you’re considering hiring Empower to manage your investments, we suggest interviewing one of their financial advisors. Their investment methodology is sound and we’ve received positive reader responses from satisfied Empower customers. Their fees are lower than most financial planners. If you have the minimum $100,000, you can speak with an Investment Advisor and receive a free Portfolio Review.

I don’t believe that Empower can replace Quicken, unless you have a very simple financial situation. Otherwise the advanced and customizable reporting and tracking available at Quicken, make it worth the fee.

Unfortunately, Empower can’t import Quicken data You’ll need to link your financial accounts directly into the Empower platform, to get an up to date financial picture. Fortunately, it’s quick and easy to link your financial institutions to your Empower account.

Quicken vs. Empower – Final Wrap up

There is no clear winner in the Empower vs Quicken contest. Both platforms are comprehensive investments and money management tracking and analysis platforms. Each offers excellent retirement planning, net worth tracking, and income vs spending analyses.

We like the new Withdrawal Planner, investment check up and fee analyzer at Empower.

If you need to customize reports, input your own and manipulate data, then Quicken is superior. But whether you opt for quicken or not, Empower’s free tools are worth signing up for.

Each of the financial management programs have their advantages and disadvantages.

If you’re seeking an in depth money management tool with help slashing debt and tracking individual budgeting items then Quicken wins. Quicken also offers a credit score, although so does Credit Karma and many other free websites.

Empower is good if you don’t need in-depth budgeting but want to view, track and analyze your investments.

You do need to be prepared to field a call from a Empower representative, if you use their free tools. The rep will discuss their paid advisory tools with you. I didn’t find this too cumbersome and actually received an impressive financial overview from a financial planner, even though I did not sign up for the paid investment management.

If you want it all, for free, go with the free Empower dashboard.

But if you like the in-depth budgeting and financial reports and planning, then pony up for one of the Quicken versions.

I’m content using both Quicken and Empower.

Related

- How to Invest a Million Dollars for Income

- How to Rebalance Your Asset Allocation

- How to Save for Retirement at Age 30

- 9 Ways to Make Extra Cash on the Week-End

- Small Business Ideas for the Micro-Entrepreneur

- Best Negotiating Story Ever – Leads to More Money

- Why You Should Invest in Index Funds

- The Financial Planning Process – Steps to Wealth

- How Can Investors Receive Compounding Returns?

- Flipping Websites for Profit

- Is Blogging Dead? How to Make Money with a Blog

Disclosure: I use both Quicken and the free Empower dashboard.

*Disclosure: Please note that this article contains affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Empower Advisors Corporation (“PCAC”) compensates Wealth Media, LLC. (“Company”) for new leads. Wealth Media is not an investment client of PCAC.

7 thoughts on “Quicken vs. Empower (Personal Capital) Review: Which Is the Best Money Management Tool?”

article inaccurately states Quicken and Mint are both owned by Intuit. Quicken was spun off years ago and Mint is being shutdown.

MI Ski Bum, Thanks for keeping us on our toes. We’ve updated the article, based upon your helpful information. Best regards, Barbara

I also use both Empower and Quicken. The budgeting functions are much better with Quicken which allows budgeting by time period and by categories which is not allowed in Empower. Empower does not allow Cash transactions to be entered which is permitted in Quicken. Empower has a nice portfolio Allocation feature but there is little customization allowed to change the category of investment which Empower assigns. The report section of Quicken is very good and allows a great many options for customized reports and exportable data. Quicken investment tracker and portfolio performance is better also.

Hi Joel, Thank you for sharing your honest experience with both platforms. I’m sure it will help readers decide for themselves. Best, Barbara

I am a longtime Quicken user who is “test driving” Empower. I agree with Joel’s comments and if I had to choose one over the other it would be Quicken. The startup time is faster for Empower but the details that you might be interested in are more readily available in Quicken. The knock against Quicken has been that it’s been around awhile. Personally, I think that’s a plus. I would add that something I look for in all programs/apps is the ability to export your data and use it somewhere else. Both Quicken and Empower have this option.

Hi Rick, Thanks for your thoughts. Since the Empower Investment, Spending, Saving and Retirement Planning Tools are FREE, it’s worth it to give it a try. For the day-to-day financial management and reports, I too use Quicken. Neither are perfect, but together you get some solid financial management software with each platform.

Hi Rick, Thanks for sharing your thoughts. If you’re serious about deep dive reports and customized investment tracking, then Quicken works. But, it’s not without it’s occasionally bugs (like all online software). For retirement planning and investment check up, Empower is great! I really like them both, although I’d be remiss if I didn’t mention that there are the occasional challenges of uploaading data with each!