How to Create a Diversified Index Fund Portfolio?

The advantage of structuring a diversified index fund DIY portfolio is that once it’s complete, it requires minimal attention. Annual rebalancing and updating prices, dividends and capital gains and you’re done managing your investments.

Taking control of your investing today eliminates financial worries tomorrow.

Investing is for Long Term Goals

Invest today to have money for your future wants and needs.

Investing is only for long term goals. If you need money in five years or less, then place those funds in a short term certificate of deposit, Government I bond, or money market mutual fund. Investing offers the opportunity for higher returns, but along with those higher returns, comes more volatility. You don’t want the money you need for a home down payment in three years to drop in value in year two.

Create a Diversified Index Fund Portfolio

1. Where do I invest for long term goals?

Now that you’ve heard the warning, only invest with long term funds, let’s talk about where to put your investment funds.

If your workplace offers a workplace retirement fund such as a Roth IRA, 401(K), or 403(B) where you contribute part of your pre-tax salary, then that is where to open your investment account. It’s best to contribute the maximum amount allowable by law. In 2022, you are allowed to contribute $20,500 to your 401(k), 403(b) and 457 plans. You can contribute up to $6,000 to an IRA or Roth IRA. If you’re over 55 you’re allowed to contribute $7,000. If you can’t swing that much, make sure to contribute at least enough to get a full employer match.

Check with the human resources office for assistance in opening the account and selecting the funds and percentages.

If your workplace doesn’t offer a retirement plan, open a Roth IRA on your own. I recommend going to a discount broker such as Charles Schwab, Fidelity, or Vanguard. If you want to start investing with a small amount, you might consider opening a Roth IRA with a robo-advisor like M1 Finance or SoFi. They both offer premade managed portfolios or the opportunity to create your own. The investment minimums are rock-bottom, below $100 for each one.

Also, consider investing in a taxable brokerage account, for additional wealth-building.

2. How do I determine my risk tolerance?

Your risk tolerance you can stomach, when your investment values decline. Stock and bond returns occasionally drop in value. If you are a conservative investor and can’t handle a 20+% drop in value, then you are a more conservative investor. If you’re comfortable with the occasional drops in value in your investments, you might be an aggressive investor.

Younger investors can take a bit more risk because you have more time to make up any investment losses. Those nearing retirement or wary of even a small loss want to be a bit more conservative, with a larger amount in bond and cash assets and a smaller percentage in stocks.

Aggressive investors own greater percentages of stocks or stock funds while conservative investors own greater amounts of bonds and cash.

Your risk tolerance drives your asset classes allocation decision. Check out the “Sleep at Night Guide to Risk” to estimate your risk tolerance level.

3. How many asset classes should I invest in?

This step gets down to how simple or complex you want your portfolio to be. There’s no right answer here. If you are a “no muss no fuss” type of person and want to keep things simple, you can achieve a diversified portfolio with as few as two or three mutual funds or ETFs. If you want a more targeted asset classes diversification, choose a few additional funds.

Remember that even by investing in just three index funds, you’ll have exposure to thousands of stocks and bonds.

4. Should I use a robo-advisor instead?

If the entire process is more than you want to take on, you might consider using a robo-advisor or automated investment advisor. These computerized services help you assess your risk tolerance and then recommend a diversified investment portfolio that fits with your financial goals, timeline and risk comfort level. There are over 30 to choose from in the U.S.

If you’re opening a new brokerage or retirement account, here are a few of our favorite low-fee robo-advisors.

- M1 Finance – $100 minimum, no fee, access to 60 customized portfolios and stock, ETF, and crypto investing.

- Wealthfront – Robo-advisor with customization options to add ETFs and crypto.

- SoFi Automated Investing – Free robo-advisor with no minimum and financial advisors.

5. How to choose my asset allocation?

Your asset allocation is the percent you allocate to stock, bond, and other types of investments. For the do-it-yourselfers, this step integrates your comfort level with risk and number of preferred asset classes. A slightly aggressive investor desiring a simple asset classes portfolio might choose a portfolio with 33% in a diversified bond fund, 33% in a diversified international stock fund, and 34% in a U.S. stock market index fund.

Sample Diversified Index Fund Portfolios

Low Risk Tolerance-Conservative Investor

40% Stock Funds – 60% Bond Funds

You are either a senior citizen or uncomfortable with significant declines in the value of your investment portfolio.

Your portfolio will have more fixed assets (cash and bonds) and less stock investments than the more aggressive portfolios.

- 30% U.S. short-term bonds

- 30% TIPS fund

- 40% All world stock

Moderate Risk Tolerance Investor

65% Stock Funds – 30% Bond Funds – 5% Real Estate

You can tolerate some volatility, and might be in your 50’s or 60’s and don’t want too high a percent of risky assets.

- 40% Total U.S. stock market

- 25% All world (ex-US) stock

- 30% Short term bond fund

- 5% REIT

Hi Risk Tolerance Aggressive Investor

70% Stock Funds – 20% Bond Funds – 10% Real Estate

You understand that in the long term stocks outperformed all other asset classes. You are confident that in the long term even the largest portfolio declines will be offset by increases in value, due to growing global companies.

Your portfolio will have more stock investments and fewer fixed investments.

- 45% Total U.S. stock market

- 25% All world (ex-US) stock

- 30% Short term bond fund

- 10% REIT

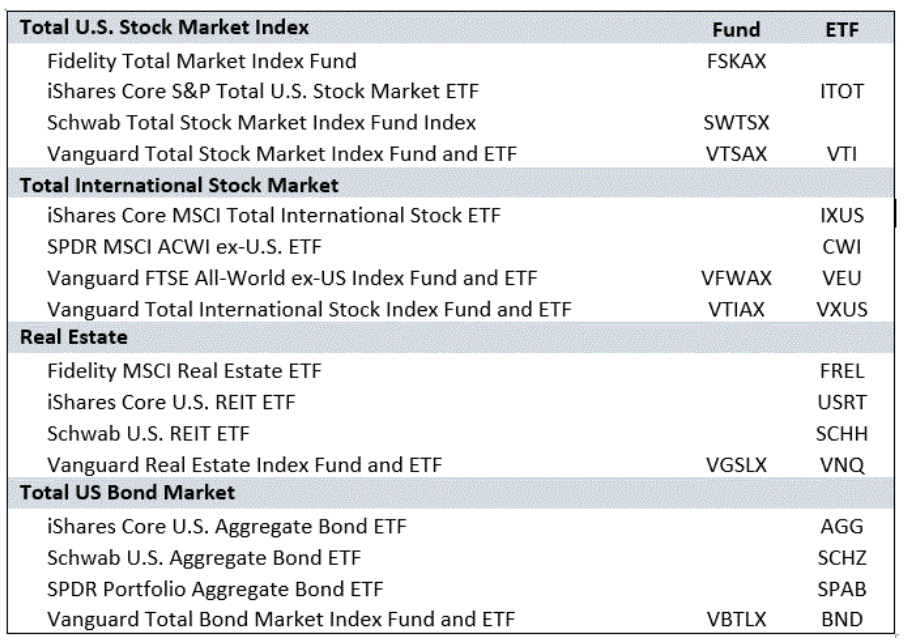

6. How to Pick ETFs or mutual funds.

There’s no magic to choosing a specific ETF or mutual fund. Choose the low fee index funds from the available selection from your workplace retirement account. For a Roth IRA or taxable brokerage account, choose low fee index funds from the a major low-fee, diversified fund family. It doesn’t really matter if you choose Vanguard, Schwab, Fidelity, SPDR or iShares index funds.

Sample ETFs and Mutual Funds for a Diversified Index Fund Portfolio

7. Regularly transfer money from your paycheck into your investment account.

Now that you opened the account, it’s time to fund it. Simply set up an automatic transfer from your paycheck, or bank account into the investment account.

If you’re transferring to a workplace retirement account, the human resources department will assist with the process. For accounts at financial firms, talk with a representative or follow the online instructions, to learn how to transfer funds from your bank account into the brokerage account.

Designate the funds and percent invested in each one, and your investing is on autopilot.

Auto invest ensures that you continue to invest through thick and thin. This simple procedure safeguards against jumping in and out of the markets when you’re scared or elated. It’s important to continue investing during declining markets, as that’s when the greatest profits are made.

8. Each year, rebalance your assets and revert to your original asset classes allocation.

Rebalancing means that you compare the percentages within each asset class and buy or sell the shares in the existing funds to return to your desired asset mix. So if you have a 60% stock and 40% bond allocation and over the year stocks outperformed bonds, you investment mix might drift to 70% stock and 30% bond. You’ll sell 10% of your stock allocation and buy the same amount of the bond funds.

Finally, don’t look at your statements. The fund values go up and down, and there’s no benefit to worrying about short term performance for long term funds. Every year, rebalance your investment portfolio so that it returns to your predetermined asset allocation. This will force you to buy low and sell high.

Choosing a diversified investment portfolio is really quite simple. There’s no perfect way nor is there a perfect number of funds to own. Remember, each individual ETF or mutual fund owns thousands of individual assets, so even with just two or three funds, your portfolio will be very diversified. Check out some of the other articles in this series.

Part 1: What is the best investing method?

Part 2; 8 Steps to Creating a Diversified Asset Classes Portfolio (today)

Part 3: Diversification Strategy: How to Figure Out My Risk Tolerance

Part 4: What are index funds and asset classes investing?

Part 5: How to buy low and sell high using a diversified index fund asset classes portfolio

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.

Empower Advisors Corporation (“PCAC”) compensates Wealth Media, LLC. (“Company”) for new leads. Wealth Media is not an investment client of PCAC.