The Definitive Guide to Mutual Funds vs. Exchange Traded Funds (ETFs)

By, Soumyadipta Basu

Investors, you hear the terms mutual funds and exchange traded funds bandied about, but what do they mean, and what are their similarities and differences?

Before comparing the two different kinds of funds lets first understand the fundamentals of mutual funds and exchange-traded funds and then you can figure out which one (or both) are best for you.

Exchange Traded Funds vs. Mutual Funds

| Features | Exchange-traded Funds | Mutual Funds |

| Trading | ETFs are like stocks, they are actively traded and continuously priced throughout the trading day. Investors can place orders throughout the day using a brokerage account. | Mutual funds are bought and sold only at the end of the trading day. |

| Minimum Investment | The minimum investment is determined by the investment company from which you buy the shares. | The mutual fund company determines the minimum investment amount and it might be higher than that of an ETF. |

| Pricing | Share prices fluctuate throughout the day as such the price of the fund may trade below or above the NAV depending on the time of the day. | All shareholders receive the same price determined by the NAV of the fund at the close of market (EST) |

| Expense ratio | The ETF expense ratio is typically lower since most ETFs are passively managed. | Typically, mutual funds charge higher fees than ETFs. |

| Transparency | The holdings of ETFs are published daily, so as an investor, you know exactly what you are holding. | Mutual fund holdings are published quarterly and usually on a lagging basis. By the time the fund holdings are published, they might not reflect those investments currently in the fund. |

| Trading cost | Investors typically pay a commission when buying or selling ETFs. Although, some investment companies allow commission-free ETF trading. | There is typically a set fee for buying or selling a mutual fund. |

| Tax Efficiency | Index ETFs are tax efficient. Actively traded ETFs might yield higher tax bills. | Index mutual funds are typically tax efficient. Actively traded mutual funds might yield higher tax bills. When investor redemptions are not offset by cash inflows from investors, the redemptions might trigger portfolio trading, which may have tax implications for shareholders. |

What is a Mutual Fund?

Back in 1924, most Americans couldn’t afford to buy individual stocks due to their high cost. Investing was reserved for institutions or the extraordinarily wealthy – until a new investment called a “mutual fund” was invented. Mutual funds offered investors the opportunity to pool their money and buy stocks, bonds and other investments “mutually.”

Yea! Investors could participate in stock and bond ownership, just like the big players.

A mutual fund might include all stocks, all bonds or a mix of various types of investments. For example, the Vanguard 500 Index Fund (VFINX) owns all the stocks that are held in the S&P 500 index, a proxy for the 500 most important U.S. companies.

It’d be tough to buy shares in each of those 500 firms on your own!

Bonus; Rebalancing Your Investments and Other First World Problems

For the average small investor, mutual funds can be a smart and cost-effective way to invest.

While individual purchase minimums may vary by fund and can be as low as $100—most funds will let you buy shares with as little as $2,500. In addition, minimums are often waived or reduced if you buy a fund within a retirement account or use certain brokerage features like automatic investments to regularly invest over a set time period.

What’s the Price of a Mutual Fund?

The price of the mutual fund, also known as its net asset value (NAV) is determined by the total value of the securities in the portfolio, divided by the number of the fund’s outstanding shares. This price fluctuates based on the value of the securities held by the portfolio at the end of each business day. So, if Company A’s stock price increases on Monday, then the mutual fund price will reflect that increase.

Regardless of the time of day you put in an order to buy or sell shares, mutual funds are priced and traded only once per day, at the close of the market.

What are Mutual Fund Fees?

You’ll pay an annual management fee, expressed as a percent of the value of your investment. If you pay 1%, then for a $1,000 investment, you’ll pay $10 per year. Some mutual funds also charge front end and/or back end loads, which are commissions when you buy (front end) or sell (back end). There are other fees called 12B-1 fees that go towards fund advertising.

Today, mutual fund fees are declining, as many mutual funds charge only a management expense ratio and not the other fees.

FINRA (Financial Industry Regulatory Authority) offers a handy fund analyzer calculator to help you compare fees on various funds.

Chart source; https://www.fool.com/investing/etf/2017/06/16/the-3-best-low-cost-index-funds.aspx

Mutual Fund Benefits

Many mutual funds charge nothing to buy and sell. That makes these investments perfect for dollar cost averaging, or buying a set amount each month.

Find out; The Secret to Why I Don’t Invest in Individual Stocks Anymore

Actively managed mutual funds give you the chance to buy in to the expertise of an experienced investment manager for a reasonable fee. With over 7,000 mutual funds, there is a passive, active or strategy funds for any investor.

What is an Exchange-traded Fund (ETF)?

The first ETF in the U.S. was launched in 1993 and was designed to own the same investments as the S&P 500. Since then, the ETF market has expanded, and now includes hundreds of funds, including very specific, narrowly focused funds tracking smaller and smaller segments of the stock and bond markets.

An ETF is a collection (or “basket”) of tens, hundreds, or sometimes thousands of stocks or bonds in a single fund, similar to a mutual fund. But the way you buy and sell ETF’s is different than how you trade mutual funds. You can buy and sell an ETF on major stock exchanges worldwide, just like an individual stock or bond.

An ETF is bought and sold like a company stock during the day when the stock exchanges are open.

Just like a stock, an ETF has a ticker symbol and intraday price data can be easily obtained throughout the trading day. Unlike a company stock, the number of shares outstanding for an ETF changes daily because of the continuous creation of new shares and the redemption of existing shares. The ability of an ETF to issue and redeem shares on an ongoing basis keeps the market price of ETFs in line with their underlying securities.

Initially, most ETFs were “passively managed.” This simply means that they were designed to follow a particular index and that there is no portfolio manager actively trading stocks and bonds inside the fund (like there is with an actively managed mutual fund).

Today, ETFs come in many varieties mirror every nook and cranny of investment markets from sector stock funds to international bond ETfs. For instance, if you think the markets will fall, you can buy the speculative ProShares UltraPro Short 3x S&P 500 fund (SPXU).

What is the Price of an ETF?

Unlike mutual funds, an ETF reflects the intersection of supply and demand for shares.

The net asset value (NAV) of an ETF, like that of a mutual fund is equal to the value of the shares within the fund. But, due to buying and selling during the day, the ETF might sell for more (a premium) of less (a discount) than the NAV.

What are ETF Fees?

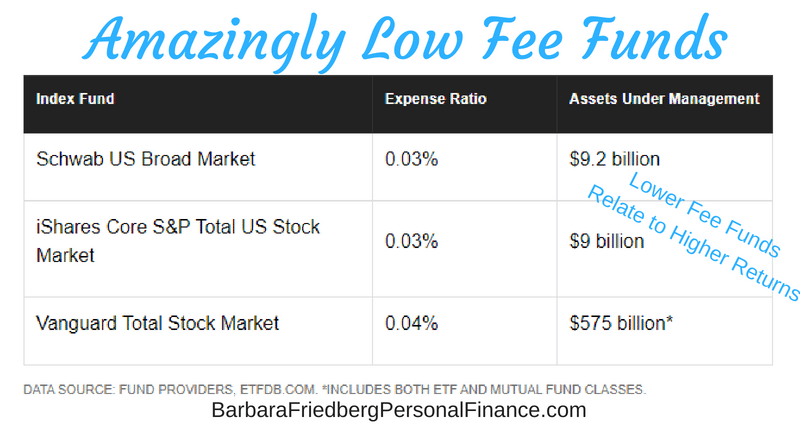

When an ETF tracks an index without trying to outperform it, it incurs fewer administrative costs than actively managed portfolios. Typical ETF management fees are lower than an actively managed fund, coming in less than .20% annually, as opposed to the over 1% yearly cost of some mutual funds. In fact, many index funds such as the Schwab US Broad Market and iShares Core S&P Total US Stock Market charge a rock-bottom expense ratio of 0.03%.

The fees are charged as a percent of the total value of your investment. So, if you own $10,000 worth of a fund, a .03% management fee would be a paltry $3.00.

When you buy or sell an ETF you might pay a trading commission, like the one you’d pay buying or selling a stock. That fee will range from $4.95 on up. Although, some investment companies have a limited number of ETF’s you can buy commission-free.

ETF Benefits

The exceptionally low management fees make ETFs outstanding investments. Most of your money, invested into an ETF goes toward the investments, not into the fund managers pockets.

Learn; How to Invest and Beat the Pros

Passively managed ETFs are also tax efficient. Since the securities are bought and sold infrequently, ETFs are less likely than actively managed portfolios to create potentially high capital gains distributions. Fewer trades into and out of the trust mean fewer taxable distributions and a more efficient overall return on investment.

Mutual and Exchange Traded Fund Similarities

Successful investors diversify their portfolios so that when one investment goes down, you’ll own others that will hold steady or increase, cushioning the volatility. In short, don’t put all their eggs in one basket. Both mutual funds and ETFs offer wide diversification.

You can also automatically reinvest income from dividends and capital gain distributions or make additional investments at any time. For most funds, the required minimum initial investment is substantially less than what you would have to invest to build a diversified portfolio of individual stocks.

The securities held within the portfolio often pay dividends, which is like interest. So, when you buy a fund, you have the chance of capital appreciation, if the fund increases in value plus income from dividends.

Of course, the value of your fund can also drop.

As with any investment, mutual funds and ETfs are risky as the principal and investment return will fluctuate over time. For long term investors, both ETFs and mutual funds are great tools to grow your wealth. Just be willing to ride the wild swings of stock markets.

Should You Invest in Mutual Funds, Exchange Traded Funds or Both?

A typical investor might own a mix of both mutual funds and exchange-traded funds.

If you are an active investor, ETFs are better suited for you since you are trading ETFs throughout the day. Mutual funds can only be bought at the end of the day. In addition, ETFs offer transparency, allowing investors to review holdings daily and monitor portfolio risk exposures more frequently than with traditional open-ended mutual funds.

Bonus; What are Index Funds and Asset Classes Investing?

If you dollar cost average by investing a set amount every month, you don’t want to pay a commission each time you invest. Thus, no load mutual funds are best for those investing each month.

In summary, mutual funds and ETFs are more similar than not. Both offer exposure to a diversified basket of securities and are good vehicles to help meet your investment objectives. Be mindful of fees, as lower fee investments, have been proven to outperform higher fee funds. So, choose the best fund for your specific investing needs, whether an ETF, an open-ended mutual fund, or a combination of both.

Related

How to Get Rich Without Winning the Lottery

Soumyadipta Basu, an engineer by trade, has 10+ years of experience in personal finance, cost evaluation and investing. He offers easy, no hassle effective strategies for busy families to cut costs and build wealth for themselves and their kids.