Do I Need Bonds in my Portfolio?

“The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future” John Maynard Keynes

One of the foremost economists of the last century succinctly states a reason to invest. Learn the simple principles of investing through this MBA series taken directly from the graduate course I recently taught in Investing & Portfolio Management. Don’t be intimidated, grasp this important investment concept in an easy to understand format.

After reading this article you will gain a usable investing skill.

As I mentioned previously, please follow these steps before beginning any investment program.

What Are Bonds?

Last class we talked about risk versus reward. In investing, the greater the risk, the greater the opportunity for reward or a high return. Risk means that your investment is going to go up and down in value; with higher risk investments exhibiting greater volatility. The recent stock market plunge shows why you may want to temper investment volatility.

Before investing, it’s always important to understand what you’re investing in. So, what is a bond?

A bond is a loan to a corporation, municipality, or government. When you buy a bond you are making a loan to the bond issuer. In exchange for the loan, you receive an interest payment. The amount of interest you are paid is directly related to amount of risk you are taking. (The interest in bonds is called a coupon payment).

Buy a corporate bond from a corporation with financial troubles, you get a high interest rate because if that company goes bankrupt, you might lose all of your initial investment.

Buy a U.S. government bond, you get lower interest rate, because your money is invested with a secure government who will pay you back your original investment when the bond matures.

A government bond is the safest bond to buy; it also has the lowest interest rate. Riskier bonds pay higher interest rates.

Bonus; Would You Invest in a 100% Muni Bond Portfolio?

Why You Need Bonds in Your Investment Portfolio – A Walk Down Memory Lane

Jose is 33 years old, married, with term life insurance, 6 months cash in a savings account. He pays off his credit card bill in full every month. Three years ago, he and his wife invested in 2 index mutual funds:

He believed that since these 2 funds held lots of different companies from various parts of the world, he was sufficiently diversified and did not need any other investments.

Let’s look at a slice in time when the stock market was performing poorly.

Revisit a time when the stock market was performing poorly.

Here are the returns of Jose’s investment portfolio from 2007-2010:

| Fund | Percent in Fund | 3 Year Return |

| Vanguard Total Stock Market Index (VTSMX) | 50% | -07.68% |

| Vanguard Total International Stock Index (VGTSX) | 50% | -10.25% |

| COMBINED RETURN FROM BOTH INVESTMENTS | 100% | -08.97% |

Now, take a look at a revised portfolio with bonds included from 2007-2010:

| Fund | Percent in Fund | 3 Year Return |

| Vanguard Total Stock Market Index (VTSMX) | 33% | -7.68% |

| Vanguard Total International Stock Index (VGTSX) | 33% | -10.25% |

| Vanguard Total Bond Index (VBMFX) | 34% | 7.17% |

| COMBINED RETURN FROM ALL 3 INVESTMENTS | 100% | -03.45% |

From 2007-2010, the first portfolio, with no bonds lost 8.97% over three years. When we added bonds to the portfolio, there was still a negative return of 3.45%, but surpassed the overall return of the all stock portfolio.

So why are we talking about investment returns from 2007-2010?

Today, with a booming stock market, it’s easy to forget that market returns are volatile. Investors tend to have short memories. For those who just started in the markets during the last 5 years, you may be unaware that stocks have negative return years as well as positive return periods.

The Takeaway from “Do I Need Bonds In My Portfolio?”

- Investing is only for money needed in 5 years or more, because in the short term, the returns are volatile. The August, 2015 market drop proves that.

- As long term returns of stocks and bonds are usually positive and greater than returns in savings accounts, these investments are beneficial for generating long term wealth.

- Combine bonds, stocks, and some cash to an investment portfolio to lower risk (volatility).

- A combination of stocks, bonds, and cash will likely beat the investment returns over a cash savings account over the long term.

Why do I need bonds in my portfolio if investment returns are sometimes negative?

- Historically long term returns for stocks are about 9%, bonds near 5%, and cash in the low single digits.

- Combine the three assets, reduce risk, and increase returns over cash alone.

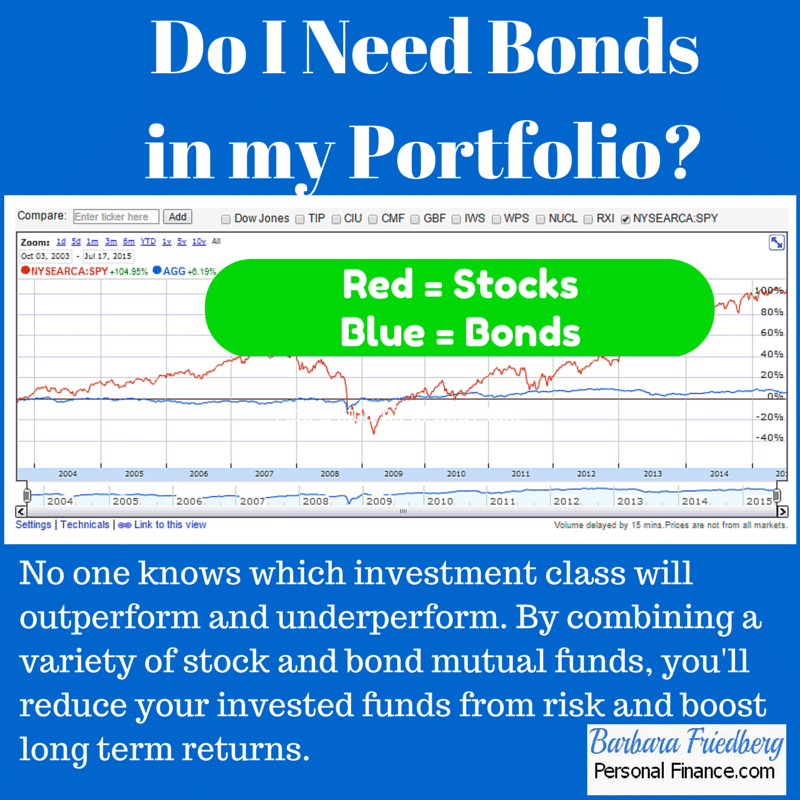

- No one knows which investment class will outperform and underperform. By combining a variety of stock and bond mutual funds, you’ll reduce your invested funds from risk and boost long term returns.

Action Step

Keep investing simple and consistent.

Invest regularly in bond and stock index mutual or ETF funds to build long term wealth.

The final answer to “Do I need bonds in my portfolio?” Yes!

Click here if you want to solve your investing problems.

>>> MBA Course: Investing & Portfolio Management Class-The Lazy Investor’s Guide to Asset Allocation

A version of this article was previously published.