5 Step-Lazy Investing Asset Allocation Guide

“Trying to consistently pick investments that are going to beat their benchmarks is like trying to win a marathon wearing muddy boots. There is a lot of drag, and your odds of winning are very low. The high costs associated with attempting to beat the market will almost guarantee sluggish results.” ― Richard A. Ferri, All About Asset Allocation, Second Edition

Who doesn’t want to amass a lot of money for retirement?

Of course you want build a big nest egg. But if you’re like most people, you’re not sure how much to save or where to invest. The Lazy Investors Asset Allocation Guide will help.

This article’s important if you:

- Don’t want a lot of muss and fuss in your investing approach.

- Want good, market-matching investment results.

Don’t be confused, this guide is a ‘lazy asset allocation’, but it’s not ‘easy’. Like anything of value, even the lazy investors asset allocation guide requires a degree of discipline and the commitment to make life trade-offs.

Contents

- 5 Step-Lazy Investing Asset Allocation Guide

- Budgeting > Investing-The Lazy Investors Asset Allocation Guide

- Step 1-Lazy Investing Asset Allocation

- Step 2-Lazy Asset Allocation-How Much to Invest?

- Step 3-Lazy Asset Allocation-Where to Invest

- Stock, Bond, and Cash Returns

- Step 4-Lazy Asset Allocation-What Percent to Invest in Stock vs Bond Fund?

- Step 5-Lazy Asset Allocation-The Guarantee

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

As Richard A. Ferri infers in the opening quote, trying to beat the market is difficult if not impossible. With so much information online about tricks and strategies to make boat loads of money with investing, you’d think it would be a snap. Yet, the average individual can end up overwhelmed, confused and immobilized. Additionally, it’s very difficult to assess who to follow and which approach makes the most sense.

This article gives you a lazy investing approach to build a high 6 figure retirement portfolio, no matter how old you are.

Budgeting > Investing-The Lazy Investors Asset Allocation Guide

I started reading Jane Bryant Quinn’s finance writing before many of you were born. In an early investing book of hers, the title long forgotten, taught me one of the most important investing concepts. This is so simple it borders on insulting, so those of you who already practice this strategy, just bear with me a moment.

This wealth tip requires no budgeting or planning. It’s actually a total retirement planning approach without having to create a budget. You don’t need a budget if you follow Step 1-Lazy Asset Allocation, inspired by Jane Bryant Quinn.

Please click to tweet and let your friends know about the Lazy Investors Asset Allocation Guide.Step 1-Lazy Investing Asset Allocation

Set up an automatic transfer directly from your paycheck (or bank account) into an investing account. It could be a workplace 401(k), IRA, investment brokerage account or all three. This ensures your financial future is secure (unless you subsequently withdraw the money). You don’t see the money in your checking or savings account, so you don’t spend it. It is growing for your retirement and other far off goals.

This eliminates the need for a lot of budgeting, because you know that your retirement planning is taken care of.

Here’s the budgeting part-you can spend whatever is left your account, knowing that your future is secure. No budget is necessary. When your spending money is gone, that’s it, you are done spending.

Step 2-Lazy Asset Allocation-How Much to Invest?

How to reach $787 355 by retirement?

It’s not enough to transfer money into an investment account. You have to diversify your investment dollars among stock and bond investments. The stock investments should be invested in your home country and internationally, for the greatest diversification benefit.

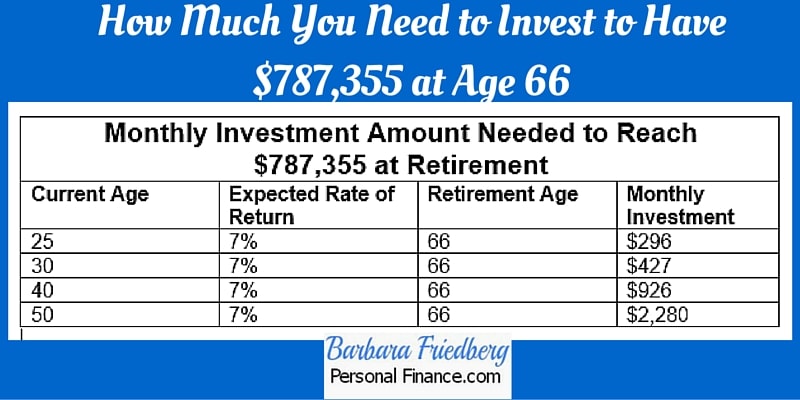

Following is the monthly amount you need to invest each month, assuming a 7% annualized return, in order to have $787,355 at retirement age 66.

Step 3-Lazy Asset Allocation-Where to Invest

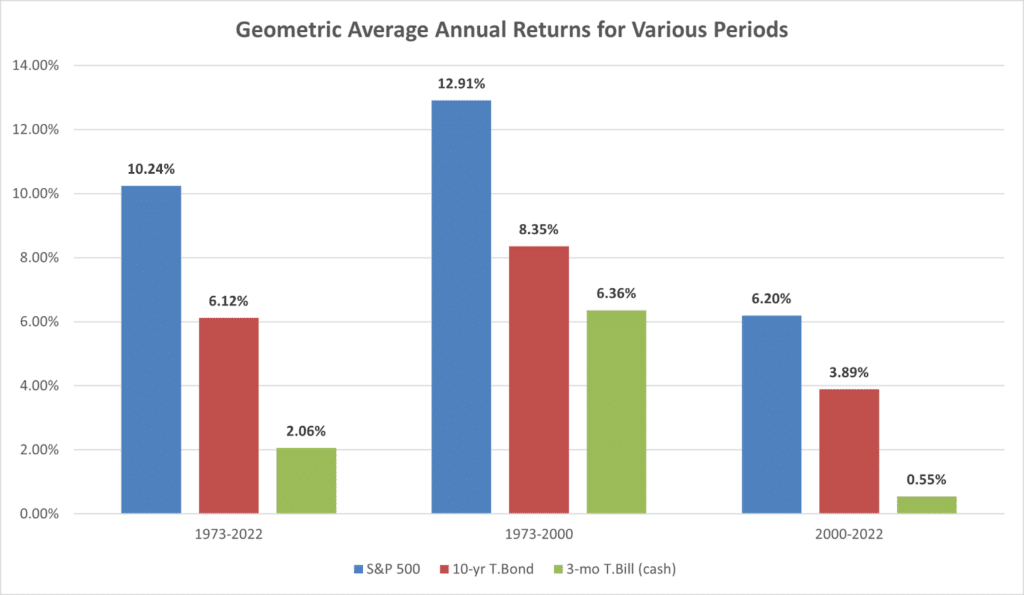

Where to invest to reach $787,355 by retirement? The following chart shows the average annual returns of stocks, bonds, and cash, during various periods. The standout feature is that stocks always delivered higher returns than bonds and cash, over the long term.

Stock, Bond, and Cash Returns

Data source: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Lazy Investing in Stock Funds

If you’re younger and can handle the risk, or volatility of stock market investing, then you’ll allocate a greater percent into stock funds. Those older, more conservative investors will invest more in bond or fixed income investments.

For example, you might invest a larger percent of your monthly allocation into an all world stock index fund: Vanguard Total World Stock Index Fund-Investor Shares (VTWSX) or the related ETF (VT). Or, you could go with an S&P 500 index fund such as the SPDR® S&P 500® ETF Trust (SPY). And add in a small allocation to international funds, if you don’t select an all-world combined U.S. and international stock ETF. An example of a low fee, diversified international stock fund is the iShares Core MSCI Total International Stock ETF (IXUS).

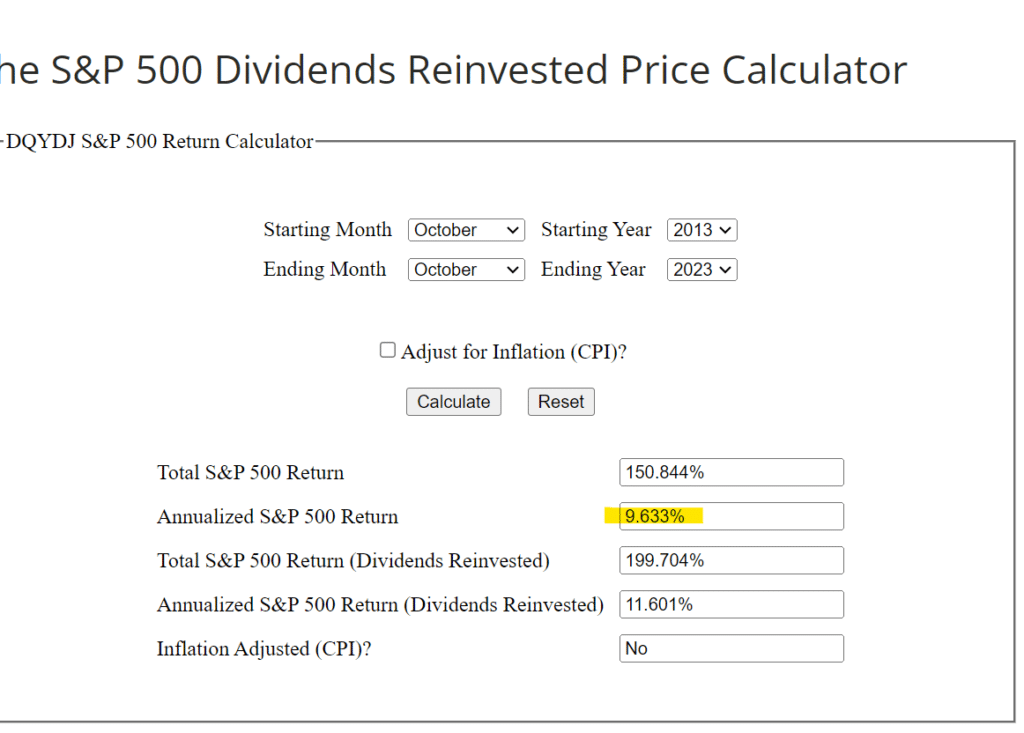

In fact, stock investors have been nicely rewarded with solid long term returns. Those that started investing in 2000, were hurt by the dot-com bubble bursting during the early part of the decade and only received and average 2000 through 2022 annualized return of 6.2%. But, those who’ve been investing for decades, will find average annualized stock market returns between 9 and 10%. While investors who began investing in the stock market 10 years ago, have received an annualized return, with dividends reinvested of 9.6%.

source: https://dqydj.com/sp-500-return-calculator/

Lazy Investing in Bond Funds

To increase diversification and reduce volatility, invest a smaller percent of your monthly contribution in a widely diversified bond fund such as iShares Core US Aggregate Bond (AGG).

With just a few funds, you can create a diversified asset allocation.

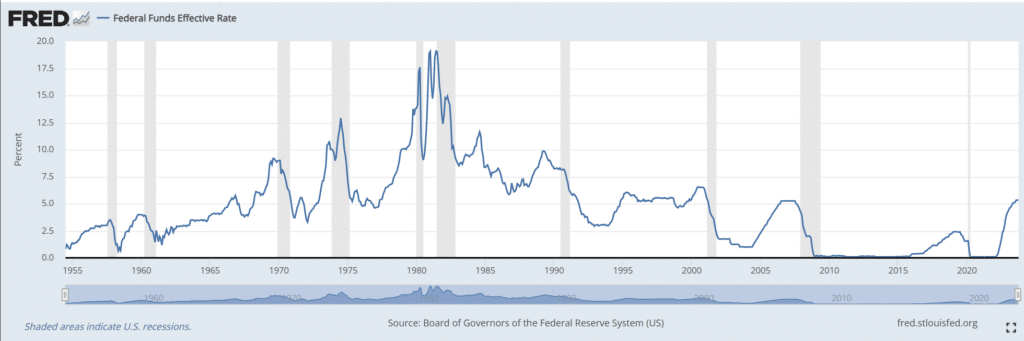

I’d be remiss if I didn’t address the unusual bond market returns over the prior decades. With interest rates near zero for most of the last 20 years, you might ask, about whether it’s even worth it to invest in bonds. Since bond returns are negatively correlated with interest rates, as interest have risen during the past year or so, investors have seen their existing bond values, decline.

Source: https://fred.stlouisfed.org/series/FEDFUNDS

But, with the run up in interest rates, investors in bond funds are currently receiving roughly 5% income from the bond fund investments. And, if interest rates decline, the value of your bond funds will rise in value and deliver capital gains.

That’s the benefit of diversification, in most cases, when one asset class declines, there will be another to prop up returns, and vice versa.

Include international investments in your portfolio to benefit from growing international economies. Click here to get a successful approach to make more money with investing.Finally, your personal future investment return will also be dependent upon what percent you allocate to the stock portion and the bond portion of your investment portfolio and how these asset classes perform in the future. .

In general, a higher percent invested in stock assets leads to higher long term returns with accompanying greater price swings. The younger investors can afford to tilt their portfolios more heavily toward stock investments because they have a longer time horizon in which to make up any losses.

In the lazy investors asset allocation example we used a 7% annualized rate of return. This is a hypothetical example and your return over time may be higher or lower based upon market returns and your personal asset allocation, going forward.

Step 4-Lazy Asset Allocation-What Percent to Invest in Stock vs Bond Fund?

Money Magazine recently suggested a new rule of thumb for asset allocation. Subtract your age from 120 and that is the percentage of your total investments you should hold in stock assets, with the balance in bond investments. According to this rule, a 50 year old should have 70% (120-50) in VT and 30% in AGG.

Try the CNN Money asset allocation calculator to help fine tune your personal asset allocation!

Or, check out one of our favorite FREE retirement planning calculators. Just click on the image below, link or manually input your investment accounts, and you’ll receive solid online advice about how to invest for retirement.

Richard Ferri also offers lazy portfolio ideas on his website.

Step 5-Lazy Asset Allocation-The Guarantee

There is no guarantee that you’ll reach your goal! But if you start investing regularly now, you have the potential to amass $787,355, or more, for retirement.

If you’re not keen on investing on your own, then WiserAdvisor will recommend three vetted financial advisors in your area, to help with your investment planning. These financial planners have been screened and are selected to match your specific needs. Click on the image below, answer a few questions, and the financial advisors will contact you, with no obligation or fee.

Please be advised that this is not a recommendation to buy or sell any specific investments, for personalized advice, please consult your own investment advisor, I am not a registered investment advisor.

Related

- Investing Lazy Portfolios Drill Down

- Why Is Asset Allocation Important?

- What Are Index Funds And Asset Classes Investing?

- Strategic vs Tactical vs Dynamic Asset Allocation

- Best Personal Investment Strategy For Women

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.

Empower Advisors Corporation (“PCAC”) compensates Wealth Media, LLC. (“Company”) for new leads. Wealth Media is not an investment client of PCAC.