The stock and bond markets are the most established financial assets providing global investment opportunities for long-term wealth building. However, in the short term they can be risky investments due to their volatility.

Historically, long term returns of the stock market have been positive, as have those of bond investments. But, over short periods stock and bond returns might be negative. Therefore, understanding historical stock and bond returns is critical if you want to be a successful investor. Historical stock and bond market returns provide information to help you make wise investment decisions.

Historical Stock and Bond Returns-Why You Should Care

I’m a bit obsessed with historical stock and bond returns. Since I’m a control freak, and the future is unknowable, knowing historical stock and bond returns gives me an illusion of control over my investments.

If you’re wondering why you should care about the average historical bond returns or stocks historical returns and performance, read on.

Knowing the average portfolio return helps you plan for the growth you can expect from your investments. Many investment calculators ask you to estimate the future return that you expect on your portfolio. Knowing the historical average returns on bonds and stocks is a good starting point to estimate your expected future investment returns.

For example, knowing 60/40 portfolio historical returns helps you estimate whether you’ll meet your financial goals. However, before we dive deeper, let’s understand some basics.

Contents

- Historical Stock and Bond Returns-Why You Should Care

- Historical Stock, Bond and Cash Returns – 95 Years

- Annual Average Return on Stocks, Bonds and Cash for 95, 50 and 10 Years

- Historical Stock, Bond and Cash Returns from 2000 – 2023

- Bonds

- What Were 60/40 Portfolio Historical Returns?

- Stock and Bond Historical Asset Classes Details

- Risk Tolerance and Historical Investment Returns

- FAQs About Historical Stock and Bond Returns

- What is the historical average return of the stock market?

- Have bonds ever outperformed stocks?

- Where can I find historical stock returns?

- What is the correlation between stock and bond returns?

- What is the average return on stocks historically?

- What is the average rate of return on stocks and bonds?

- Related

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What Are Historical Returns?

Historical investment returns refer to the past performance and rate of return of a financial asset, such as a bond, stock, security, index, or fund. For example, The average stock market returns over the past 95 years, as measured by the Standard and Poor’s 500 index is 9.8%% including reinvested dividends.

We consider the geometric, not average annual returns for investments because it includes the effect of compounding growth from different periods of return. The geometric annual average return is considered a more accurate way to measure investment performance.

However, average bond returns by year, historical stock market returns, and even cash performance vary greatly each year. To make better estimates about future returns, it’s helpful to understand the bonds vs stocks historical returns for the last 50 years, 95 years, and 10 years.

Understanding Historical Returns

To capture a financial asset’s historical returns, analysts and investors record performance from the start of a year (January 1st) to its end (December 31st). Compiling past annual returns helps you accurately picture your investments’ overall historical returns across multiple years. You can also use the same data to calculate average historic yields per year.

However, it’s essential to remember that the average returns fail to address potential changes in the rate of return. Some years may observe substantial growth, while others a decrease in performance. For example during the past three years, you’ll notice extremely divergent returns for stocks, cash, US Treasury and corporate bonds.

| Year | S&P 500 (with dividends) | 3-Month T Bill (Cash) | 10-Year T Bond (Treasury Bond) | Baa Corporate Bond |

| 2021 | 28.5% | 0.0% | -4.4% | 0.9% |

| 2022 | -18.0% | 2.0% | -17.8% | -15.1% |

| 2023 | 26.1% | 5.1% | 3.9% | 8.7% |

Higher return rates balance out the lower/negative returns over long periods of time. So, one-year returns might be lower or higher than the average, and rarely equal. Be cautious with short term yields, when predicting future returns.

You can also use a historical returns calculator to make more informed decisions and maximize your returns. It calculates the potential return on investment over a period of time. It considers factors such as taxes, inflation, and investment period. You can also use it to compare different investments and choose the one with the best return potential.

When it comes to stocks, the historical stock market returns calculator gives you the stock market performance over a period of time.

Read: Would you Invest in a 100% Muni Bond Portfolio?

If you’re wondering what the average return is for someone invested 100% in bonds, both the US Treasury bond and Baa Corporate Bond returns will give you an idea of how bonds performed in the past. In general, over longer time periods, like seven or more years, stocks average the highest returns with corporate bonds, government bonds, and cash with the lowest annual performance.

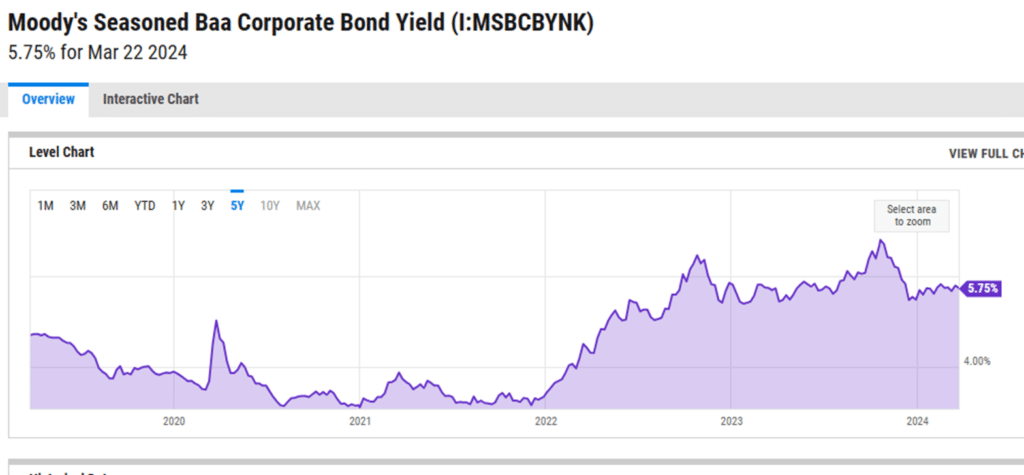

5-Year Average Baa Corporate Bond Yield

Source: https://ycharts.com/indicators/moodys_seasoned_baa_corporate_bond_yield

This 5-Year Average Baa Corporate Bond Yield chart shows the corporate bond yields, or interest payments during the prior five years. The yields along with the underlying bond price or value, will determine your annual yield. If you don’t sell the bond, then you’ll receive the stated interest payment,

Great – so do historical returns guarantee future returns?

No, not at all.

But, since the perfect crystal ball hasn’t been invented, historical stock and bond returns give you an approximation of how much you might expect to earn on an investment portfolio, over many years. Historical stock and bond returns are the next best thing to the crystal ball.

Is it possible that historical returns have nothing to do with future returns?

Of course. But if we accepted that premise, we would lack any guide to approximating future returns. So, we’ll assume that past historical bond and stock, returns can help guide our future projections.

Historical Stock, Bond and Cash Returns – 95 Years

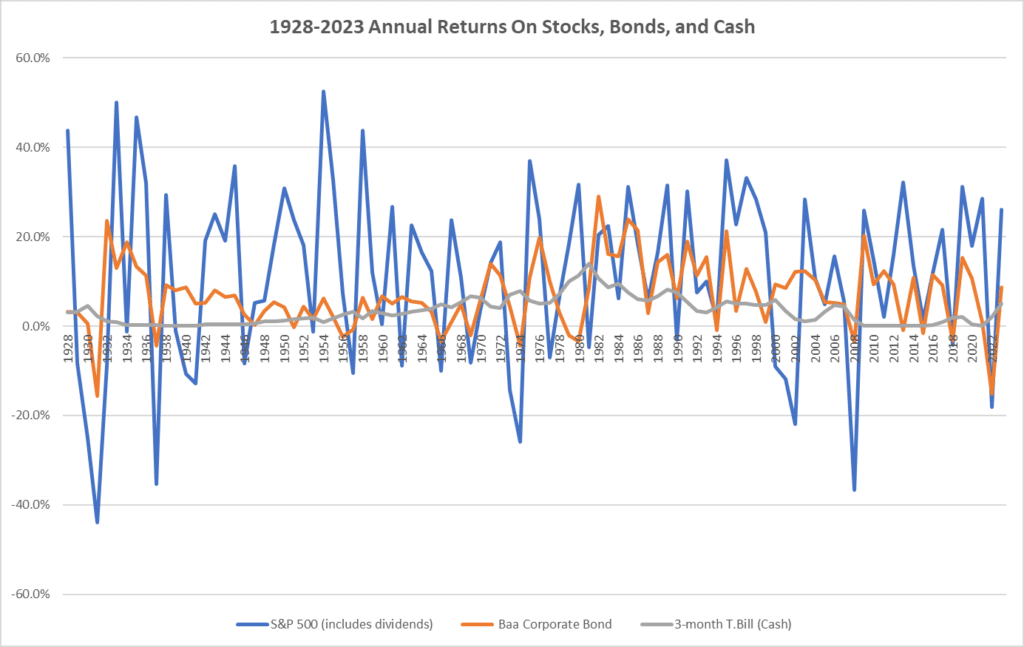

The following chart compares the annual returns of:

- Stocks – Measured by the S&P 500 index with reinvested dividends

- Bonds – Measured by the Baa Corporate Bond index

- Cash – Measured by the 3-month U.S. Treasury bonds

Data source: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Notice that stock returns are usually higher than bond returns, although not always. It’s also useful to realize that there are large differences in stock and bond returns from year to year.

In some years, stocks and bond returns show an inverse relationship; when stocks go up, bonds go down. Yet, that’s not always the case. In 1995, all asset classes were positive. The S&P 500 returned over 37%, while Treasury bills and Treasury bonds returned 5.52% and 23.48%, respectively.

As high as the returns were in 1995, in 2008, during the subprime mortgage crisis and recession, the S&P 500 declined -36.55%. That same year, the 10-year Treasury bond rewarded fixed income investors with a 20.10% gain, as investors sought safer investments.

Rarely are stock and bond returns directly correlated. Yet 2022 is the only year, during the previous 50, where stock and bonds both exhibited negative returns. In 2022, the S&P 500 lost -18.0% while the Baa Corporate Bond average lost -15.1%. While short term cash investors held steady with a 2.0% T-bill return in 2022.

Historically, stocks have the best and worst performance annual. Yet, during each 10-year period, long term stock market returns have been positive.

The 3-month U.S. Treasury bill and cash proxy had positive returns and were the least volatile asset, with the lowest average returns.

Clearly, investing in stocks is the riskiest asset class with the most volatile returns and the potential for the greatest long term returns. While bonds are less volatile with historically lower average returns.

As 2022 demonstrated, investors might consider adding cash to their portfolio in the form of 3-month Treasury Bills, certificates of deposit or high-yield cash accounts to temper the volatility of stock and bond portfolios.

Use this Empower Retirement Planner to find out if you’re on track for retirement. They do the return projections for you! (click on image below)

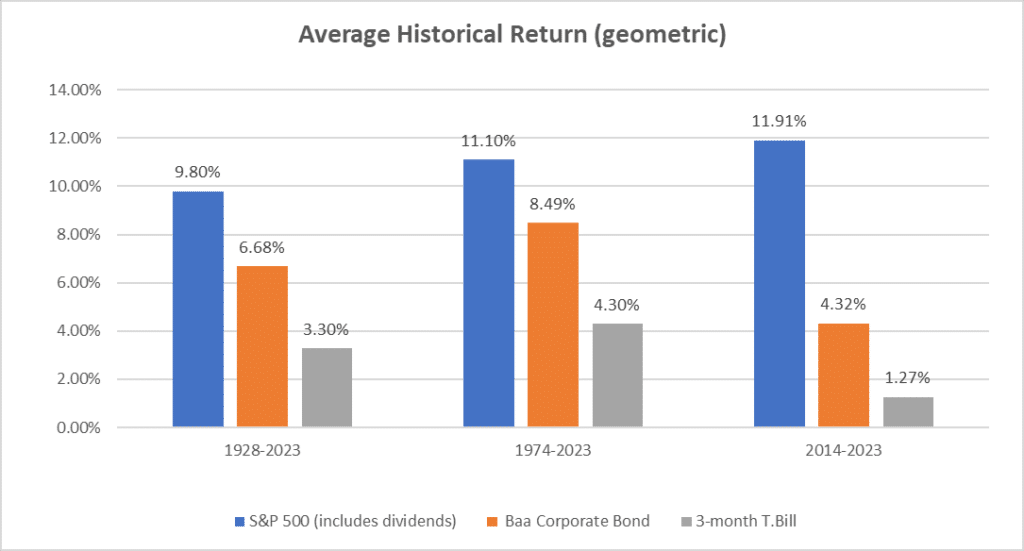

Annual Average Return on Stocks, Bonds and Cash for 95, 50 and 10 Years

The previous graph shows the 95-year annual return on stocks, corporate bonds and cash.

Next, we’ll explore the average annual returns for bonds, stocks, and cash during various periods.

Data source: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Investment returns vary depending upon the time period examined. This chart, and the one above, “1928-2023 Annual Returns on Stocks, Bonds & Cash” shows returns for each asset class during the prior 95 years. “Average Historical Return (geometric)” explores the average returns over various periods. You’ll notice that in each period of time, returns were positive for stocks, bonds and cash assets.

Over 50 years, from 1974 through 2023 stocks averaged 11.1% annual returns while Baa Corporate Bonds delivered 8.49% on average, and cash yielded 4.3%.

This golden period included the -22% drop in the Dow Jones Industrial Average (DJIA) Black Monday stock market drop and the -20.4% S&P 500 decline as well on October 19, 1987. This 50 year stock market period also spans the irrational exuberance in the stock market during the buildup of the dot-com bubble from 1995 through 1999. The last five years of the 1990’s decade saw double digit stock market returns every year.

But as we’ve seen with all stock market bubbles, there comes a breaking point and the early 2,000’s experienced losses during the first three years of the new millennium.

Examining the prior 10 years, 2014 to 2023, investment market returns were lopsided, due to historically low interest rates. The S&P 500 returned nearly 12% on average with Baa Corporate Bonds and cash returning just 4.32% and 1.27% annually.

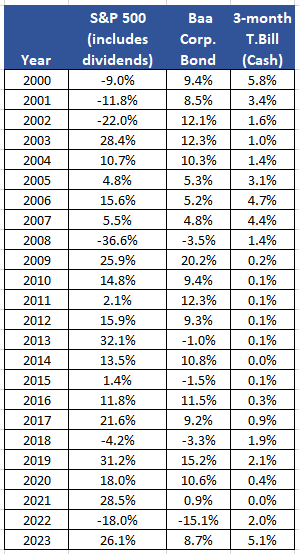

Historical Stock, Bond and Cash Returns from 2000 – 2023

If you began investing in the stock market in 2000, you would have been hit with three years of negative stock market returns. Stocks had to recover from their overvaluations at the end of the last millennium. But, with a diversified stock and bond portfolio, the stock market losses would have been tempered by the positive bond market returns.

We also saw the 2008 mortgage melt down with a -36% stock market loss. While 2022 attempted to return stocks to a more reasonable valuation, after the runup in valuations and returns from 2019 through 2021. With low inflation and low interest rates during most of this period, decent cash and fixed yields were hard to come by.

What does this mean going forward?

- If you had sold after markets fell, you might have missed the subsequent upswing in prices.

- This data recommends that most investors should invest for the long-term in a diversified investment portfolio of stocks, bonds, and a bit of cash.

- Don’t place money that you’ll need soon in the stock market, keep those dollars in short term high yield cash investments.

Can we use historical returns to predict the future?

Reversion to the Mean Drives Future Investment Returns

“Mean reversion is a theory used in finance that suggests that asset prices and historical returns eventually will revert to the long-run mean or average level of the entire dataset.,” ~Investopedia

If mean reversion holds true, then you would expect that future financial asset returns going forward will return to the averages.

1995-1999

During the last four years of the prior millennium, the S&P 500 returns were extraordinary with every year surpassing 22%:

| 1995 | 37.2% |

| 1996 | 22.7% |

| 1997 | 33.1% |

| 1998 | 28.3% |

| 1999 | 20.9% |

Most stock prices surpassed their underlying values during the late 1990’s. With high returns and stock market overvaluation, the beginning of the new millennium showed losses and drove average returns towards their averages or “reverted to the mean.”

2000-2010

A stellar example of return to the mean is demonstrated during the first ten years of the millennium.

S&P 500 Average Annual Returns – 2000 to 2009

Data source; http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

During the first three years of the decade, the stock market lost -9.03%, -11.85%, and -21.97%. If all of your investments were in the stock market, that would have been a painful three years.

During the first decade of the century, the average annual stock market return was negative -.726%, according to the DQYDJ.com S&P 500 calculator.

After the huge stock market runup in the late 1990’s, the early 2000’s is an ideal example of mean reversion.

2014 – 2023

After the dismal stock market returns at the beginning of the millennium, the most recent 10-year performance of the S&P 500 is outstanding:

- Stocks rebounded with an average 11.91% return

- Baa Corporate bonds returned 4.32% during the past 10 years

If you are seeking the answer to the question, ‘How will stock and bond markets perform in the future?’ it’s likely that you’ll find a range of responses from a variety of smart investment professionals. If reversion to the mean plays out, then you might expect a return to more moderate stock, bond and cash returns.

The volatility of investment markets is a reminder that stock and bond investing is best for money you won’t need for a long time.

Bonds

What is the average return if someone invests 100% in bonds?

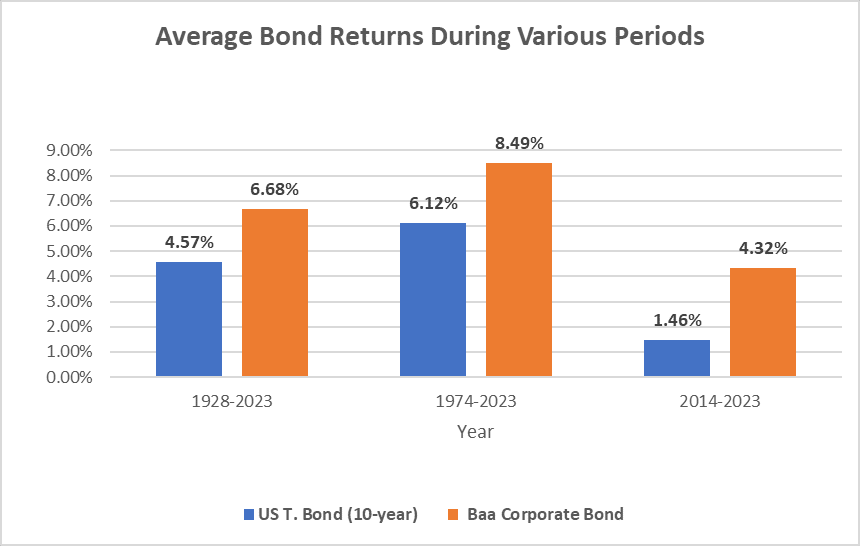

Depending upon whether you invested 100% in Treasury or corporate bonds your average returns during various periods were:

Historical bond performance is lower than stock returns. Bonds are less volatile with fewer highs and lows, in contrast with stocks.

Bond Returns and Interest Rates

What about bond performance? Can we expect future bond yields to rise?

On January 31, 1986, the Baa corporate bond yield was 11.36%. Yet, as demonstrated by the graph at the beginning of the article, corporate bond yields have trended downward since 1986, with a few periodic reversals.

Bond yields are influenced by market interest rates. When market interest rates are high, bond yields tend to rise.

When market interest rates decline, new bond issues typically offer lower yields.

But yields are only one part of bond total returns, capital appreciation is another.

When interest rates rise, the bond values decline. The annual total return of a bond and a stock is the aggregate of both interest and dividend payments, and capital gains or losses.

So, future bond performance is influenced by market interest rates.

Extremely conservative, or older investors seeking capital preservation, might lean towards investment portfolios with greater allocations to bond investments.

What Were 60/40 Portfolio Historical Returns?

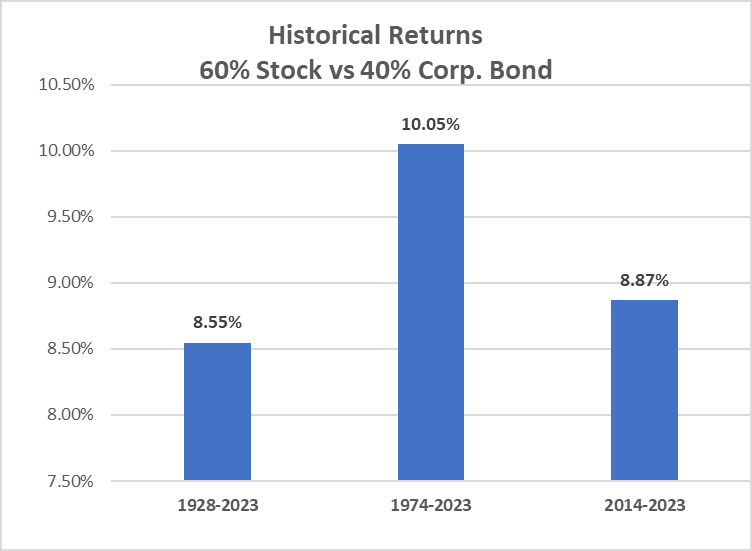

Many portfolio managers, financial planners and investors adhere to a 60/40 investment portfolio. This equates to 60% invested in stocks and 40% invested in bonds.

To calculate a 60/40 portfolio historical return, we’ll use the S&P 500 average returns for the 60% stock portion and the Baa corporate bond average returns for the 40% bond/fixed investment category. The diversification of a stock and bond portfolio will temper the ups and downs of your investments.

Your returns will vary depending upon how many distinct stock asset classes and types of bond assets you select, as well as the specific time period.

60/40 Portfolio Historical Returns Chart

Learn: Should I Buy Bonds Now?

Stock and Bond Historical Asset Classes Details

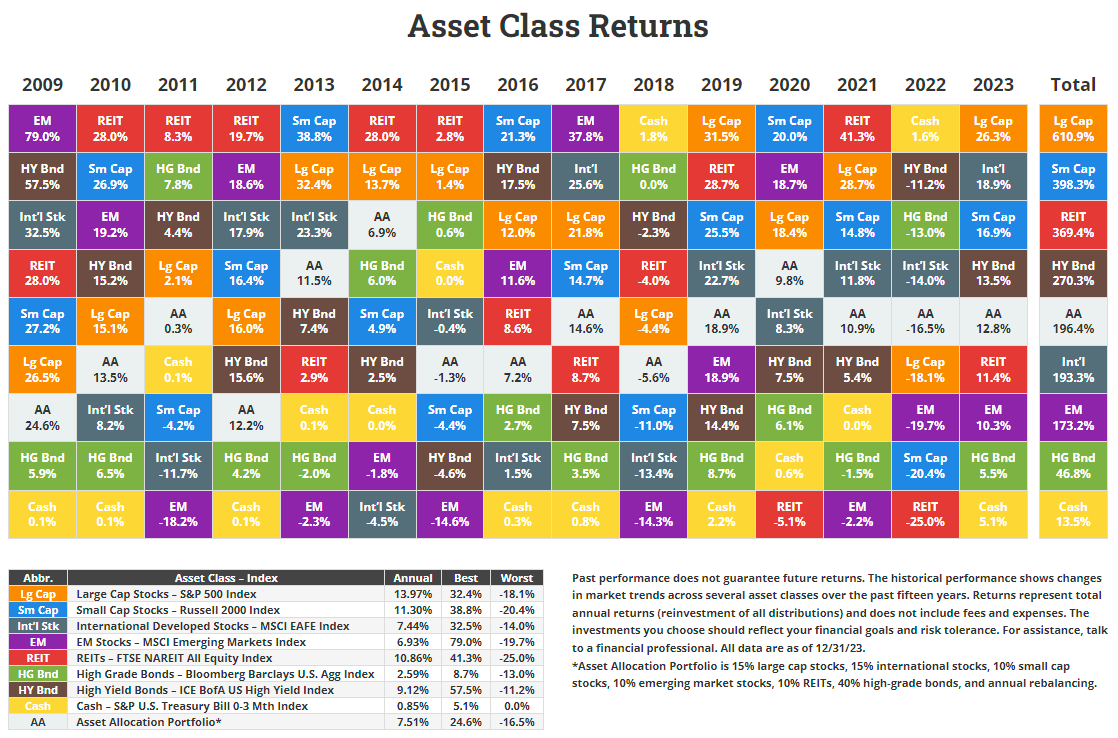

We’ve been discussing the broad stock market proxy, the S&P 500 and two bond categories, government and corporate. Within these broad categories, there are many types of investments, that have their own characteristics.

The table below, from NovelInvestor.com ranks the best to worst investment returns by asset class over the past 15 years.

Source: NovelInvestor.com

Source: NovelInvestor.com

Risk Tolerance and Historical Investment Returns

Your risk tolerance, or comfort with the ups and downs of your investment portfolio will drive your investment mix.

More conservative investors and those that are approaching retirement will lean towards an investment portfolio with a greater percent of bond and fixed income investments.

Younger and more aggressive investors will own greater percentages of stock investments.

This “Best Asset Allocation Based on Age and Risk Tolerance” will give you a rubrick for choosing your investment mix.

You’ll also find risk tolerance and asset allocation templates. I also like Rick Ferri’s Core 4, for easy to craft investment portfolios.

After you’ve selected a reasonable asset allocation, then use the historical asset class returns to help understand potential expected future returns.

Be cautious of websites that suggest future stock market returns will be greater than 9% or 10%. Maybe this will hold for a year or two, but the chances are slim that the stock and bond market returns will match those of the previous decade.

Diversification and Asset Allocation Matter- Here’s Why

Ultimately, you want to create a diversified investment portfolio, so if one asset class tanks, you’ll be saved from disaster with other better performing ones.

For example, during the first decade of the century with deplorable stock market returns, emerging market stocks averaged over 9% per year.

Historical Stock and Bond Returns Return Wrap Up

No one can predict future investment returns. But, the educated investor who’s aware of the average bond returns and the average stock returns has a leg up on the less-informed investor. The most successful long-term investors take the time to learn about investment markets history.

By learning about historical stock market and bond returns, you’ll have a barometer for a possible range of investment performance possibilities. Then, integrate the reversion to the mean theory, economic news, the Fed and world events into your stock and bond market analysis.

Understanding these concepts will make you a confident investor today and into the future.

FAQs About Historical Stock and Bond Returns

What is the historical average return of the stock market?

The historical average return of the stock market over the long term is slightly more than 10% in the stock market, as indicated by the S&P index. In fact, over the past 10 years, through to December 31, 2023 the annualized S&P 500 performance was 11.91%, demonstrating an outstanding growth rate.

Have bonds ever outperformed stocks?

Yes. Notice the chart above that illustrates the “50 Year Annual Returns of Stocks, Bonds and Cash”. Any time the green bond line is above the blue stocks line, bonds have outperformed stock returns. You’ll notice that before 2011, there were many years when bonds outperformed stock market returns.

Where can I find historical stock returns?

The Macro Trends website provides detailed S&P 500 Historical Annual Returns if you’re interested in learning more about stock market returns. Additionally, the NYU Stern website provides historical returns on stocks, bonds, corporates, gold and real estate. Investopedia also has a great article on the Average Return of the Stock Market: S&P 500, Dow Jones.

What is the correlation between stock and bond returns?

The correlation between stocks and bond returns is the most critical aspect when constructing a traditional portfolio. During the first 2 decades of the 21st century, stocks and bonds often moved in the opposite direction (negative correlation). Due to the negative correlation, investors largely relied on their bond investments for protection from volatile equity markets. Bonds and stocks are typical inversely correlated, but not always.

What is the average return on stocks historically?

Historically, the average return on stocks is 10+%. However, it’s important to remember that not everyone can expect this average rate of return as the markets are often unpredictable. Thus, conservative investors should lower their expectations and forecast a 7-8% long-term portfolio performance when investing in stocks. Historically, long term stock market returns have been positive.

What is the average rate of return on stocks and bonds?

The 95-year average rate of return on stocks, as measured by the S&P 500, with reinvested dividends is 9.80%. During that same period, Baa corporate bonds returned an average of 6.68% and 10-year US Treasury bonds delivered an average 4.57% return.

Related

- 7 alternatives To Cash – How To Get A Good Returns

- Are Bonds A Good Investment Now?

- Why Asset Allocation Is Important

- Is A 10% Return Good Or Bad?

- The Secret To Flawless Investment Management-For Free

f you need help with your investments, we’ve partnered with WiserAdvisor to provide you with access to three vetted Financial Advisors – in your area. Click the image below to sign up. (no obligation when signing up)

Data sources; http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.

Empower Advisors Corporation (“PCAC”) compensates Wealth Media, LLC. (“Company”) for new leads. Wealth Media is not an investment client of PCAC.

2 thoughts on “Historical Stock and Bond Returns – Predict Future Investment Performance”

Hello Ms. Friedberg,

I am a real estate appraiser in Ottawa Canada trying to help one of our Migmaw First Nations and the government of Canada settle a land claim originating in 1862.

I am looking for a time series of long bond rates for the US that goes back at least as far as 1862 to help me model the loss of use of the land. Do you possess such data and on what terms would you be willing to share it? I will leave my email below if you have any questions.

Thanks for your consideration,

Norris Wilson BA, AACI

Why do all the negative market comments fail to mention the heart of the US stock market, the Nasdaq 100? As you know it would be bigger than the S&P but the top 10 holdings include 9 Nasdaq stocks. The S&P is just the Nasdaq with 400 stocks that have not made much recently. These Nasdaq whales are the new railroad stocks of the world.

Why not encourage people with what is actually happening instead of spinning in whatever direction you must want to go? Do you tell the “savvy professionals” the real stuff?