What is a Target Date Fund?

Are you interested in buying one fund which holds all the stock and bond mutual funds you need? A target date fund (TDF) is like a big box retailer or a shopping mall. At the mall, you can buy everything you need at one destination. In a target date fund, you get all of your investing needs met within one fund.

How the Target Date Retirement Fund Works

A company, such as Vanguard, Fidelity or countless others create a mutual fund or exchange traded fund (ETF) for investors expecting to retire in a specific year. The fund offers several stock and bond mutual funds or ETFs in one set-it-and-forget-it investment.

Contents

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

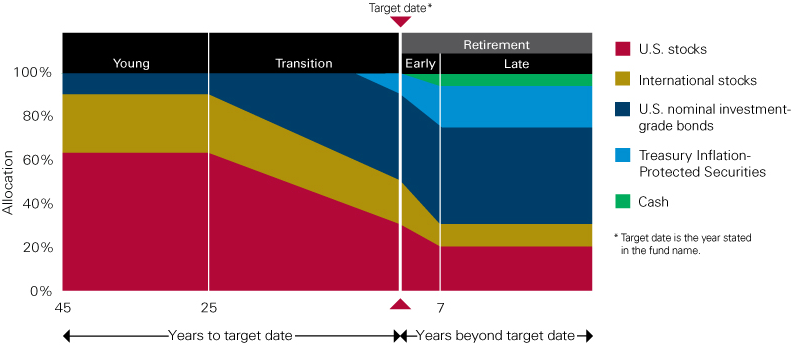

The fund’s asset allocation starts out aggressive with a greater percentage in stock funds. As the target date, or your retirement date approaches, the fund becomes more conservative and sells some of the more agressive stock funds and buys more of the conservative bond funds.

The chart above shows how each company’s TDF has differing asset allocations. With 30 years until retirement, T Rowe Price and Fidelity have 90% invested in the the US and international stock markets. Once the target date is reached, the steadier fixed income category ranges from 45% to 55%. It’s important to investigate the fund’s glidepath, to ensure you’re comforable with asset allocation.

A 30 year old in 2021 who wants to retire at age 65 would buy the 2020 + 35 or 2055 Target date fund. (The funds are typically available in 5 year intervals.)

Before you commit to what appears to be the “perfect” financial solution, understand that like any investment, there are pros and cons to a target date fund.

Source: https://retirementplans.vanguard.com/VGApp/pe/pubeducation/investing/LTgoals/TargetRetirementFunds.jsf

Pros and Cons of Target Date Funds

Pros

1. Accesible – Many 401k plans offer target date funds. This makes allocating your 401k plan cash a breeze.

2. Abundant choices – If you have a retirement or brokerage account outside work, such as an IRA or Roth IRA, you can purchase a target date fund in your account. From Fidelity, TRowe Price, Schwab, to Vanguard, most popular financial firms offer their own brand of target date fund.

3 . Simplicity – One of the benefits target-date funds offer is simplicity. Instead of choosing a mix of investments, the fund chooses and rebalances your investments for you. TDFs are designed with a glidepath towards more risky or aggressive asset allocations for target dates that are farther in the future, when time is on your side to make up any losses due to market fluctuations. As the target date approaches, the funds’ allocations scale down risk to make it less likely (although not impossible) that large losses will take place.

4. Not just for your retirement plan – For the simplest investing approach, you could purchase a target date fund for a future goal. Parents might consider a TDF to align with the year Junior starts college. As long as the desired withdrawal date is roughly 8-10 years or more away, the fund works great to grow your contributions for a future goal.

We recommend investing as much as possible when you are younger, to give your money more time to grow, compound, and make up for any losing years in the markets. TDFs make is easy to save for retirement!

Cons

1. Fees can be high – As with any fund of funds, there are two layers of fees. First, there’s the specific fund management fee for each individual ETF or mutual fund. Next, there’s an additional management fee on top of the individual fund’s cost is typically expressed as a percent of assets under management (AUM). A recent Morningstar study found that returns for TGFs explained 28% of the differences in fees between the top 20% and those ranked in the third-quintile of 2040 funds.

2. No customization – The one-size approach may not work with your investing preferences. TGFs don’t account for each person’s needs, risk tolerance, and goals. These funds may not consider investments that you feel intuitively or through research may pay off; likewise, these funds may automatically allocate some of your money toward investments you would prefer not to select.

3. Target-date funds don’t eliminate market risk – As with any investment, your assets can fluctuate in either direction. The history of any one fund cannot accurately predict its future. There is no guarantee of growth even as you approach your target date and the investments become less risky.

4. TGFs lack active management – Some investors prefer actively managed funds or like to invest on their own. If you are in those categories, then this isn’t the investment for you.

Risk-averse investors might not be comfortable with this type of investment. The heavy allocation to equities during the earlier years, might not be right for an investor uncomfortable with even small losses.

Target Date Fund Alternatives

1. Do it yourself investors might prefer to choose their own funds and forgo the TDF management fee. Although, that requires the investor to periodically adjust the asset allocation as he or she gets older and closer to retirement. It’s easy to buy a few ETFs and rebalance them back to your preferred asset allocation periodically.

2. One of my preferred Target Date Fund alternatives are the pre-made portfolios at M1 Finance. It’s easy to select a 10% stock – 90% bond on up to a 90% stock -10% bond portfolio with the pre-made “Just Stocks and Bonds” portfolio. M1 will rebalance the investments for free! Or you could select from a variety of other pre-made choices. (Here’s a peak at my dividend growth premade portfolio at M1.)

3. Robo-advisors are an alternative to target date funds. They are automatic digital investment managers- some with human financial advisor’s too. There are all sorts of varieties, with various investment minimums and management charges.

4. Add a small cap value fund to your target date fund. Paul Merriman, founder of the educational organization by the same name proposes investors add a small cap value fund to a TDF. His research has found that due to the historical outperformance of small cap value stocks of time, this will improve your long term investment returns.

FAQ

For the first few years past the target date, the asset allocation will continue to become more conservative, with greater allocations to steadier bond funds and less to more volatile stock funds. Seven years after the target date, the Vanguard TDF settles on a constant 70% stock and 30% fixed allocation. This will provide stability in value with a small amount of growth.

Typically, the TDF with the lowest fees will offer the best performance. Most TDF invest in similar US and international stock funds and various bond funds. So, the differentiator in returns is usually fees, with lower fees correlating with higher returns.

Fees can be too high, with some offers. The asset allocation might n0t be suitable for your preferences. If you can’t tolerage risk, but you are in your 30’s or 40’s, the TDF might be too heavily invested in riskier stock funds.

Wrap Up

Target date mutual funds pros and cons depend upon the type of investment you’re seeking. For some, the elegance of a set-it-and-forget-it solution solves your retirement saving problems. For others, the lack of customizability and fees might be a deterrent. When a company is bundling several mutual funds under one umbrella, you may end up paying two layers of fees.

Because target-date funds recalibrate their investments, or the percentages in stock funds versus bond funds, as time goes on, many people can take comfort knowing that their level of risk will decrease and that their funds will, eventually, be reallocated. This prevents stagnant investments, and also allows less confident investors to take comfort in the knowledge that they have little to do in the way of decision-making.

This can also keep nervous investors from making bad investment choices due to their anxiety over the ups and downs of financial markets.

Your own investing style needs to be considered when evaluating retirement needs and the goals you have for your investments. By educating yourself on target-date funds and your alternatives, you can make an informed and potentially lucrative decision about how to best fund your later years.

Ultimately, target date funds are neither good nor bad.

After reviewing the target date fund pros and cons as well as your own situation, decide whether a TGF is the right choice for you or not.

Related

How to Boost Social Security 8% Per Year & 5 Retirement Tips

15 Best Ways to Withdraw Retirement Funds

Target Date Fund Tax Considerations

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.

Empower Advisors Corporation (“PCAC”) compensates Wealth Media, LLC. (“Company”) for new leads. Wealth Media is not an investment client of PCAC.