The Friedberg Family Portfolio Today

(For informational purposes only)

“Of course. I favor passive investing for most investors, because markets are amazingly successful devices for incorporating information into stock prices.” Merton Miller

I love it when an economist espouses my opinion! Short and sweet; this quote is the premise of the Friedberg personal portfolio. In PART 1 of this series, I talked about my investing FEARS. In PART 2 you learned how I began investing in individual stocks

MAIN TOPIC

Today, the WHAT & WHY of the Friedberg family asset allocation is unveiled. The bulk of our assets are held in LOW COST INDEX MUTUAL FUND’S OR ETF’S. Although we still have a few individual stocks in our personal portfolio, they represent a very small percentage of the total. Additionally, there are some funds which are actively managed not index funds in old retirement accounts from prior jobs This is not a post where you will see our net worth, but what I think is more important, you will learn the percent we allocate to certain asset classes and why. After many years of researching individual stocks, buying and selling in both our personal family portfolio and the professional portfolio I manage, I began to drift away from that approach. In 2008 I graduated with an MBA in Finance having studied investing research quite a bit during my graduate studies. Here’s a tiny summary of what I learned about investing:

- Although not totally efficient, the market is efficient enough to make it difficult to beat over the long term.

- Most successful managers fail to beat the market consistently over many years.

- An investor’s asset allocation accounts for about 90% of his/her returns. (That means the types of assets you choose are more important than individual stocks or funds). WOW-that was a big one!

- Invest more in stock type investments for an opportunity for greater returns along with more volatility (or RISK).

- Greater investment in bonds usually yields lower returns with less RISK (except for the past few years).

- There is a slight bias of the market over the long term for small stocks & value stocks to beat the market averages.

All of these findings describe HISTORICAL generalizations, not the future. As anyone who has read an investment ad or seen a commercial on TV knows, the past is not a predictor of the future! Armed with this wonderful historical investment information and a bit weary of individual stock analysis and upkeep, in 2008 I began moving toward a diversified index fund/ETF portfolio. (If you are unsure of the meaning of any of these terms, stop by Investorwords and get the definition.) BACKGROUND and RISK TOLERANCE: Before picking an asset allocation you need a general idea of how much up and down (RISK) you can stomach in the value of your investment portfolio. Then you also need to make sure to take these steps before you even think about investing. My risk tolerance is a bit higher than average. I remain fairly impassionate about the drops in value of our investment portfolio and don’t tend to overreact to these market declines. That said, El Carino and I are in the mid section of our lives and so would be hard pressed to recoup a huge loss. Also, for psychological reasons, I like to have access to some cash in case I need it for anything; it reduces my anxiety.

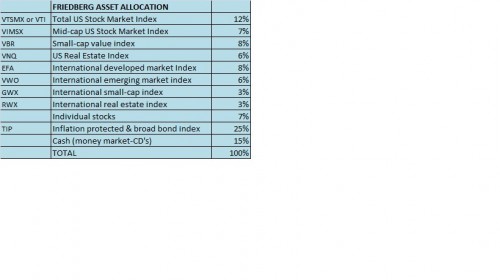

PRACTICAL APPLICATION: The Friedberg Asset Allocation Unveiled

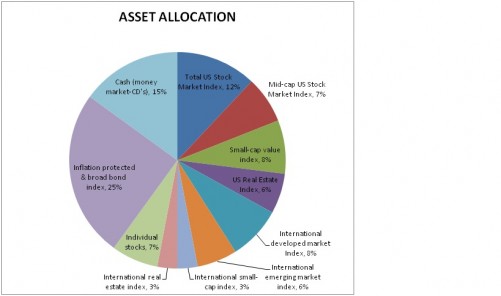

For those graph enthusiasts, here’s a pie chart of the asset allocation of our investment portfolio:

This next chart offers the actual ticker symbols (type a ticker symbol into Google or Yahoo finance and get details about the asset) for our holdings.

Why these Assets?

-

51% STOCKS – Stocks offer the opportunity for growth and a hedge against inflation. As we’re in the middle part of our lives, we want to shelter our portfolio from too much volatility.

-

7% MIDCAP STOCK INDEX– This was the best alternative from El Carino’s workplace retirement plan options.

-

9% REAL ESTATE ASSETS – Real estate investments are also a hedge against inflation and also offer diversification; when other asset classes go down, real estate values may go up or not move down as much.

-

20% INTERNATIONAL – The U.S. is only 51% of the world market and its growth is slowing. Investing internationally provides some diversification and also exposure to the growth of the international market.

-

11% Small capitalization and small capitalization VALUE STOCKS- Historically smaller companies and value based companies offer greater returns over the long term.

-

25% BONDS & INFLATION PROTECTED GOVERNMENT BONDS-Protect against inflation, adds diversification and limits volatility.

-

15% CASH-Peace of mind, diversification, reduced volatility.

Why don’t the percentages add up to 100%? Because some assets fit into multiple categories. Why no gold or other commodities? The existing asset classes offer enough diversification for my taste.

For more ideas about sample asset allocations visit one of my favorite sites; The Lazy Portfolios at Marketwatch.

Caveat: This article is for information purposes only and may not be appropriate for your individual situation. A satisfactory asset allocation can be achieved with as few as 2 or 3 funds.

Share your asset allocation and how you arrived at it. Or, ask a question.