“Get over yourself. Stop thinking that there’s a magical secret formula for making tons of money overnight, and that you can discover it because you’re smarter than any other investor out there. In fact, his suggestions seem to say, when it comes to getting rich, slow and steady wins the race.”~from “Warren Buffett’s Advice: Forget Get-Rich-Quick. Here’s How to Get Rich Slowly,” in Inc.com by Minda Zetlin

You’ll read a lot of questionable stuff online about how to get rich or how to become a millionaire. And maybe you think there’s a quick route to riches. Although a few get rich fast, most affluent folks take the long route to wealth.

Caution, if you’re looking for a get rich quick scheme, look elsewhere. This strategy is the long road to wealth. But, if you follow this one step, you will have a greater chance of reaching financial independence than by following the scores of get rich quick schemes out there.

But, before you learn this one tip, you need to understand who this advice is coming from. Do your research, on me. Don’t take my word (nor should you take the word of anyone else for how to build wealth) without doing your due diligence.

Read my story. Check out my LinkedIn Page and scan my Press Page. I’ve implemented what I’m about to share.

In fact, in my mid-20’s I started saving and investing so much, despite earning a moderate salary, that there were times I had to dip into my emergency fund to make ends meet!

The only thing that I’m selling you is a proven way to build wealth – slowly. And, unless the future is very different than the prior 100 years, you have a decent chance of becoming a millionaire if you take this one step.

Full disclosure, I learned this brilliant advice from a Jane Bryant Quinn book many years ago.

So, buckle up and get ready to learn the one step to becoming a millionaire.

How to Become a Millionaire in One Step

Set up an automatic transfer of the greatest amount of money possible into a retirement investment account, 401k, 403b and/or IRA and invest this money in low-cost index funds.

This approach is genius, because once your money is out of your handy checking account, you will learn to live on what’s left. What you don’t readily see, you won’t spend.

How much you “need to live on” is actually in your mind. Once you have a roof over your head, food, transportation, insurance and a few necessities, the rest of your expenses are discretionary.

Bonus; Five Reasons to Choose Index Funds for Your Investment Portfolio

Now, this isn’t an article about how to live cheaply, but, that’s what you must do (unless you earn an enormous salary) if you want the likeliest path to wealth.

At first, it’s hard. Yet, after awhile, learning to live with less can actually become kind of fun – finding ways to live well for less. If you have no clue about how to live cheaply, you can read my How to Get Rich, Without Winning the Lottery.

Can I Become a Millionaire Just by Putting Money in a Retirement Account?

Okay, so becoming a millionaire in one step was kind of misleading. After you automatically transfer your money into the retirement account, you must invest it. Even if you’ve never invested before, are overwhelmed by the choices in your employers 401k and don’t know the difference between and IRA and IRS, you can still become a millionaire.

Investing is not rocket-science, but really simple. If you want some help setting up your retirement plan, M1 Finance offers a free investment manager. You can open a retirement account and have a specific amount of money regularly transferred into your stock and bond funds, for retirement.

Back to the legendary investor, Warren Buffett, just follow his advice. Buffett recommended that upon his death, all of his heir’s inheritance should be invested in a stock index fund and short term government bond fund, as written in a Berkshire Hathaway annual report:

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s. (NASDAQMUTFUND:VFINX)) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions, or individuals — who employ high-fee managers.” ~Warren Buffett in Berksire Hathaway annual report

Click here for a list of low fee index funds.

How Long Will it Take To Become a Millionaire

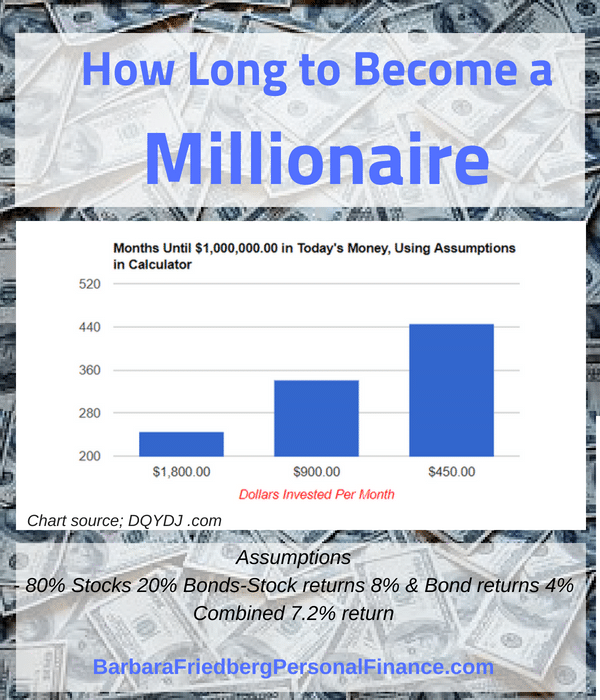

You can predict how long it will take for you to become a millionaire with a reasonable degree of accuracy (if historical investment returns prevail).

There are calculators galore that allow you to plug in your investment amount, anticipate expected returns and then spits out how long it will take you to become a millionaire. I like the calculator at DQYDJ (Don’t Quit Your Day Job).

For example, let’s assume you’re 30 years old and can invest $900 per month in your retirement account. Further, assume that with a 20% bond and 80% portfolio you earn an average of 7.2% return. (Assume a 4% bond return and 8% stock return.) The millionaire calculator estimates that you’ll become a millionaire in approximately 28.37 years. That would be a few years shy of your 60th birthday.

Cut savings in half, to $450 per month, you’ll need to save for 37.09 years to obtain millionaire status. That still leaves you with one million at age 67.

If you’re in a hurry, double your monthly savings (or work for an employer that offers to contribute to your retirement) to $1,800 and you will likely hit your goal in 20.43 years, at age 50.

Play around with the inputs and you can uncover a fair estimate of how long it will take you to become a millionaire.

Become a Millionaire in One Step Takeaway

Once, you’ve made the decision to make become a millionaire, put the plan in place to make it happen. And, if you don’t make enough money, take action and look for ways to make more money.

Next, set up an automatic transfer into your retirement accounts.

Finally, invest in low fee index funds.

As long as companies continue to grow and prosper, your plan to become a millionaire will bear fruit.

Related

Should I Pay Off My Mortgage Or Invest In The Stock Market?

Click now for free micro book-How We Grew Our Retirement Fund 538% + 14 Investing Rules for Wealth