Asset allocation is a cornerstone of creating a diversified investment portfolio.

“Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance, and investment horizon. The three main asset classes – equities, fixed-income, and cash and equivalents – have different levels of risk and return, so each will behave differently over time,” ~Investopedia.com

After you choose your asset allocation, investment rebalancing keeps your chosen portfolio mix in alignment with your initial goals. Although there’s chatter that this task increases returns, there’s little data to support this theory. The reason investors rebalance an investment portfolio is to reduce volatility of returns. That means, rebalancing tempers losses when the market tanks!

Contents

You’ll learn all about asset allocation including:

- Asset allocation cautions

- How important is rebalancing your portfolio?

- What does it mean to rebalance a portfolio?

- Portfolio rebalancing strategies

- How often should I rebalance my 401k or investments?

- How to rebalance a portfolio without selling

- Pros and cons of rebalancing

All About Asset Allocation

Asset allocation is the percent of your total investable money you direct into specific investments.

Diversification or asset allocation is described by the adage, “Don’t put all of your eggs in one basket.” Diversification of your financial assets (stock funds, bond funds and other financial investments) is the best way to temper the ups and downs of the investment markets.

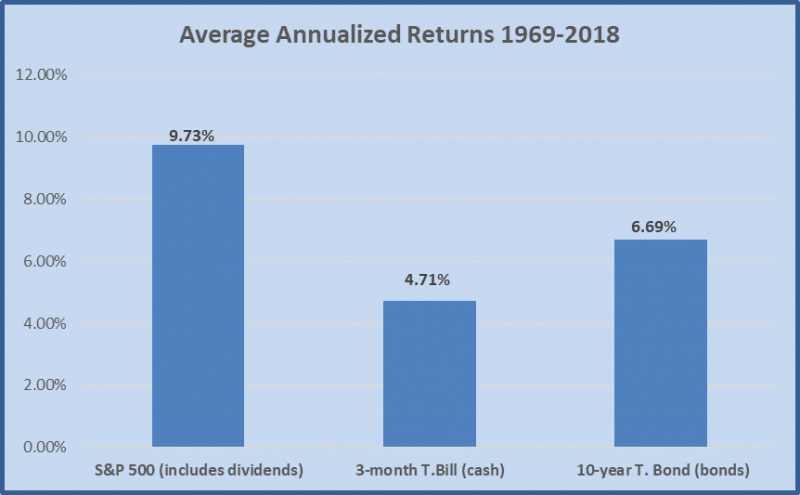

As a reminder, you invest in the stock market because over the past hundred years or so, stock market investments averaged approximately 9.0% per year. Then you add in bond funds, because, although their returns are historically lower than stocks or approximately 5.0% annually. Since bonds are less volatile and their returns don’t move in lockstep with stocks, they’ll further moderate your portfolio’s volatility.

In this next example you’ll view the returns of each asset class.

Asset Allocation Caution

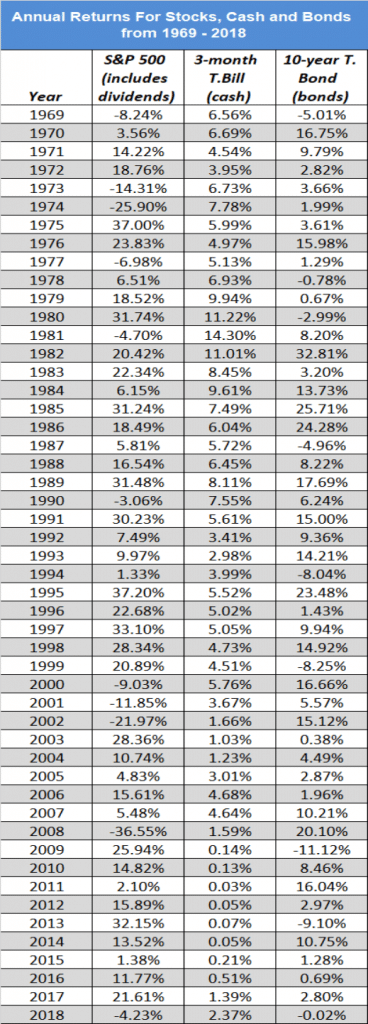

Be careful when looking at “average” returns. Look at the annual return chart below and you’ll notice several negative return years for your investment in the S&P 500 and a couple negative years for the 10 Year Treasury Bond.

This next example isn’t an attempt to scare you, but a realistic picture of how investment class returns vary from year to year. The chart below shows annual returns for stocks, bonds and cash.

Data source: Professor Damodar, NYU Stern School of Business

What if you started investing in 2000?

During the first three years of the decade, the stock market returns were negative, -9.03%, -11.85%, and -21.97%, respectively. Yet, if you had an asset allocation that included 65% stocks and 35% bonds, your overall investment returns would have been better than the all stock portfolio-although still in negative territory.

For a one year investing example, imagine that you start out the new millennium with a $1,000 investment.

Invest it all in stocks (S&P 500 index fund) and at the end of the year your $1,000 is worth $903. Invest the $1,000 in 10-year treasury bonds and at the end of the year, your money is worth $1,017. It would have been great to be all in bonds in 2000, but the problem is that at the beginning of the year, you don’t know the future direction of the stock and bond markets.

For long term investors, it’s clear, your returns in all of the asset classes were positive.

Don’t expect your returns to hit the average every year. And remember to invest for the long term – more than five to seven years. Money that you need within the next few years should be invested in safe certificates of deposit or cash.

Asset Allocation Examples

There’s no one right way to set up an investment asset allocation.

Rick Ferri of Core-4.com offers asset allocation examples with just four asset classes. Ferri’s Moderate Core-4 portfolio, designed for capital appreciation with income using stocks, bonds and real estate. It is a 60% stock, 40% fixed asset allocation:

- 36% – Total US Stock Market Index fund

- 6% – Real Estate Investment Trusts (REITs) Index fund

- 18% – Total International Stock Index fund

- 40% – US Investment-grade Bond Index fund

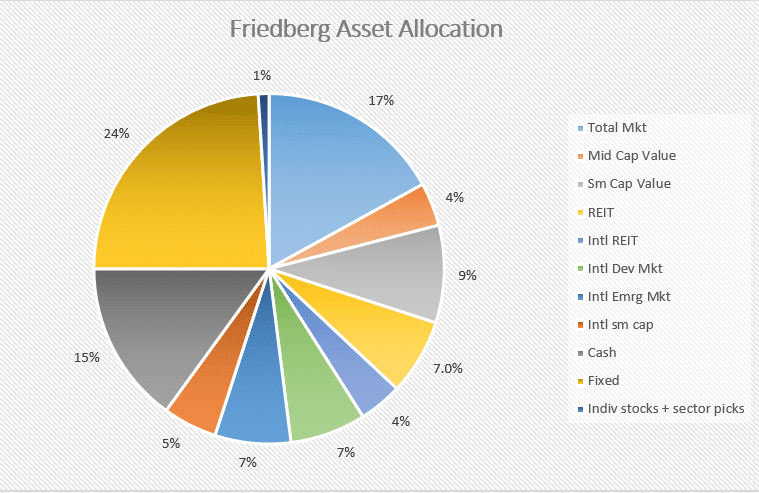

While, I prefer to delve into a broader mix of asset classes that tilt towards value and size factors.

Here’s my family’s current asset asset allocation:

Is this the best asset allocation available? You’ll only know over time.

Asset allocation models are set up based upon historical asset class returns. But, the problem is that there’s no guarantee that prior asset class returns will continue into the future.

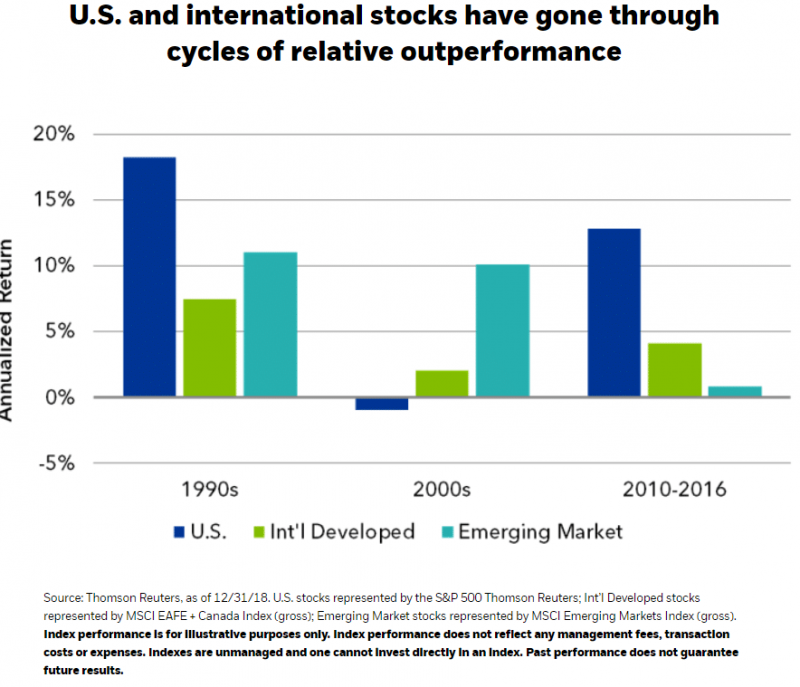

For example, during the last decade, international stock unerperfomed US stocks. Yet, go back to the 2000’s and the US was the worst performer among developed and emerging market stock investments.

source: iShares

This iShares data underscores the importance of diversification. If you had opted out of international investing in the 2000’s your investment would have missed out of the superior international stock market returns, in comparison with the US markets.

Asset Allocation Protects Against Future Market Uncertainty

The uncertainty of the future is why you set up an asset allocation. An investor moderately comfortable with risk might invest 65% in stock funds and 35% in bond funds. With several decades until retirement you figure this asset allocation seems about right.

Modern investing portfolio theory recommends determining your risk profile and then divvying up your portfolio in line with your risk level. In other words, if you can handle a bit more volatility in your investment returns, you want more stocks in your portfolio. Terrified of the cyclical ups and downs in your investment value, invest a greater percent in bonds.

Asset allocation is the investors personal decision about how to divide up your investments among basic asset classes. In general, investors divide their assets between stock and bond type investments. Younger folks, with more time until retirement and a longer working life ahead frequently benefit from an asset allocation more heavily weighted toward stock investments.

A guy in his 50’s facing retirement in fifteen years and risk averse, may choose 55% stock investments and 45% bond investments. A young woman with a high paying secure job and a high-risk tolerance chooses 75% stock investments and only 25%

What Does it Mean to Rebalance a Portfolio? How to Rebalance Your Asset Allocation

Next, you’ll meet Carter and learn exactly how this 39 year old rebalances his asset allocation.

Asset Allocation of a Moderately Aggressive 39-Year Old

Here is 39-year-old Carter’s, moderately aggressive $10,000 investment portfolio with 66% stock funds and 34% bond fund:

- $3,300 – 33% in a broadly diversified United States stock index fund

- $3,300 – 33% in a broad diversified International stock index fund

- $3,400 – 34% in an inflation protected bond fund

Carter’s asset allocation is equally divided among three mutual funds.

How to Rebalance Your Asset Allocation-Step 1

First, tabulate the value in each of your asset classes.

Assume that during a fictional year, the U.S. stock market increased 9% so Carter’s U.S. stock index fund increased to 34% of the overall portfolio. With the economic troubles in Europe, the international fund fell 5%. Finally, with the decline in market interest rates, the inflation protected bond fund increased in value 13% and grew to 38% of his total investment portfolio.

After one year, due to changes in of U.S. and international stocks and bonds, the value his portfolio was $10.574.00 for a total gain of 5.7%.

- $3,597.00 – 34% in a broadly diversified United States stock index fund

- $3,135.00 – 29.6% in a broad diversified International stock index fund

- $3,842.00 – 36.3% in an inflation protected bond fund

The goal of rebalancing is to return the proportion invested in each asset class to your original percentages; 33% in the each of the stock funds and 34% in the bond fund.

Click here for access to Free Money and Investment management dashboard. Retirement planning tools included!How to Rebalance Your Asset Allocation-Step 2

Before rebalancing, you need to know your current asset allocation.

Here are the steps to figure out your asset allocation:

1. Sum your entire investment portfolio value.

2. Divide the amount in each asset class by the value of the total portfolio and multiply by 100.

That is your current asset allocation.

Next, figure out how to rebalance to your target allocation.

3. To return to your target asset allocation, multiply the total value of the portfolio by the target asset allocation percentage. For example, for the stock fund multiply .33 by $10,574.00 and you have the targeted value of that asset class of $3,489.40. Continue for each asset class.

4. Subtract the value after year one from the value at the target asset allocation to arrive at the amount to buy or sell. For the stock fund, subtract $3,597.00 from $3,489.40 and you determine that you need to sell $1,076.00 worth of the stock fund.

Now you know the exact dollar amount of each fund to buy or sell, in order to return to your targeted asset allocation.

Portfolio Rebalancing Strategies-Step 3

When considering how to rebalance your asset allocation, there are several alternatives to rebalancing, including ‘How to Rebalance Without Selling’.

1. You can sell off the assets which have increased above the target level and buy more of those that are beneath the target. In other words, you would buy $354.42 more of the International stock index fund and sell $107.58 worth of shares of the U.S. stock fund and $246.84 of the bonds, so that the percentages return to the original proportions, as shown in the value of the target asset allocation row.

2. Another option is to invest new monies into the asset class or fund that is below the target. In this case, it’s the International stock index fund. That way the International stock index fund would increase as a percent of the total portfolio until returning to the desired allocation. This is an easy way to rebalance in a 401(k), by directing new contributions into the investment that’s declined from its original allocation percentage.

3. If your allocation is off by a small amount, like in the stock fund, you may choose to do nothing. After all, each day, when investment prices change, your asset allocation will also change.

4. Another strategy is to wait until the asset class percentages are off by a certain percent, 5% or even 10% before rebalancing. In the next section you’ll learn about the results of various rebalancing strategies.

When rebalancing your asset allocation, don’t worry about perfection, just move towards the general direction of your preferred asset allocation.

How Often to Rebalance Your Asset Allocation?

The Pros and Cons of Rebalancing

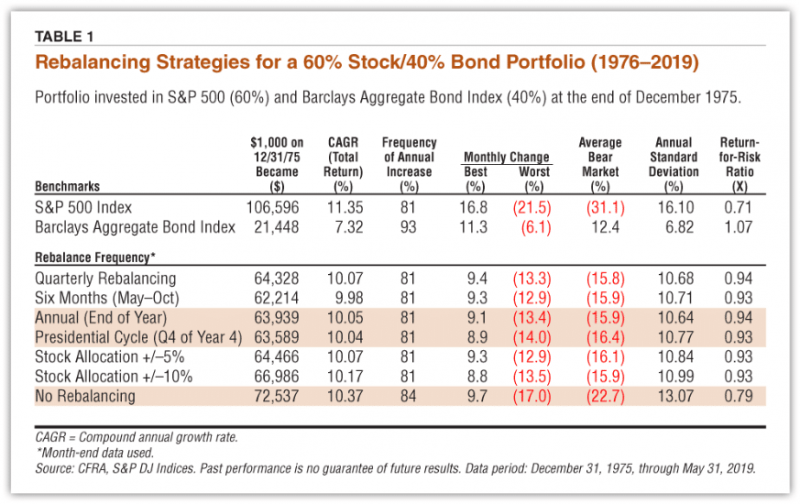

Sam Stovall reported in the August 2019 AAII.com Journal on the investment results of seven rebalancing strategies using data from 1976 through May 2019. The study referenced a 60% stock vs. 40% bond portfolio as represented by the S&P 500 stock index and Barclay’s Aggregate bond index.

The standard deviation and annualized returns were compared among all seven rebalancing approaches. The returns of the S&P 500 and Barclay’s Aggregate Bond indices benchmarks were also included.

The findings might surprise you and also save some investment time and management.

The seven rebalancing options included:

- Quarterly

- Six months in May and October

- Annual – end of year

- Presidential Cycle – fourth quarter of year four

- Stock allocation drift of +/- 5% from target allocation

- Stock allocation drift of +/- 10% from target allocation

- No rebalancing

The rebalancing schedule with the lowest compound annual growth rate was the every six months schedule with an annual return of 9.98% and a standard deviation of 10.71. This rebalancing schedule yielded a return-for-risk ratio of 0.93.

The return-for-risk or Sharpe ratio divides the return by the volatility or standard deviation. The result indicates the dollar amount of return that was generated for each dollar of risk accepted.

The second-best rebalancing schedule, as measured by annual return was the value-based approach that rebalanced only when the stock allocation was 10% above or 10% below the target value. That schedule produced a compound annual growth rate of 10.17%, a standard deviation of 10.99 and a return-for-risk ratio of 0.93. Notice that the return-for-risk ratio was the same for the worst performing and second-best rebalancing schedule.

The returns for the rebalancing schedules ranged from a low of 9.98% to a high of 10.37% with standard deviations between 10.64 and 13.07. In dollar amounts the $1,000 investment on December 31, 1975 grew to $62,214 for the six-month rebalancing portfolio and to $72,537 for the best performing by May 31, 2019.

With the exception of the best performing portfolio, there wasn’t a tremendous variability among the rebalancing schedules, standard deviations of return-for-risk ratios.

Next, the highest returning portfolio, also had the greatest standard deviation.

Skipping Rebalancing Could Lead to Higher Returns

Source; AAII Journal

The rebalancing schedule with the highest annualized return over the 43-year period was, no rebalancing. A $1,000 investment in the 60% stock vs. 40% bond portfolio made on December 31, 1975 was worth $72,537 on May 31, 2019. This computed to a compound annual growth rate of 10.37% and an annual standard deviation of 13.07. This portfolio also had the lowest return-for-risk ratio of 0.79.

This no rebalancing portfolio suffered several difficult periods. The worst monthly change for this portfolio was -17% while the average bear market decline was -22.7%. Finally, without rebalancing, the 60% stock vs. 40% bond portfolio, grew to almost 90% stocks by 2019.

When considered over a 43-year period, there was modest distinction among returns, standard deviations and return-for-risk ratios for all but the best performing portfolio. The annual returns for each portfolio were in the 10% range with return-for-risk ratios hovering in the .93 and .94 area, except for the .79 metric for the no rebalanced option.

Finally, this study found that investors could squeeze out a small return premium by not rebalancing. But the volatility and excess risk might only be appropriate for investors who can withstand the excess volatility. For the average investor, rebalancing is likely a sound portfolio management strategy. Without rebalancing, investors might be more tempted to sell after a major stock market decline and lock in their losses.

I rebalance annually most years which keeps portfolio management responsibilities manageable and moderates risk.

The Asset Allocation and Rebalancing Takeaway

If you want to set up a diversified portfolio and handle rebalancing, it’s realtively easy to manage on your own. The key takeaways are to investing in low fee index funds that cover the US and international stocks, real estate, bonds at a minimum. Add in other asset classes as desired. Then rebalance on your preferred schedule. If you want free investment management and rebalancing support, check out M1 Finance here. I have an account with the firm, and let them perform the rebalancing!

A previous version of this post was published.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.