Part 3: What is Risk Tolerance and How to Figure Out my Asset Classes Allocation

Today’s article of this multi-part series answers the question, “How to figure out my risk tolerance”.

Part 1: In How to Build an Investment Management Strategy you learned the important research behind investing with a diversified asset classes portfolio.

Part 2: Outlined the 8 Steps to Creating a Diversified Asset Classes Portfolio.

Today you will learn how to figure out your risk tolerance and begin designing your own asset classes diversification strategy.

“There are two kinds of investors, be they large or small: those who don’t know where the market is headed, and those who don’t know that they don’t know.” William Bernstein, The Intelligent Asset Allocator.

Diversification Strategy – How to Figure Out my Risk Tolerance?

There are many risk tolerance quizzes online, all promising to tell you how much volatility you can tolerate. The truth is no one cares about upward volatility, when your investment values go up. The only risk we worry about is the decline in value!

The quizzes only take you so far. You may think you can handle a 20 percent drop in your portfolio, if you’ve never experienced one. The only way you know your risk tolerance for certain is to watch the value of your investment portfolio decline.

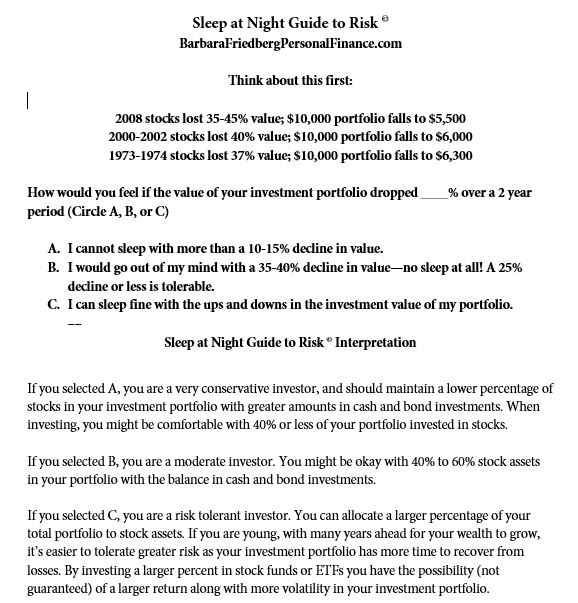

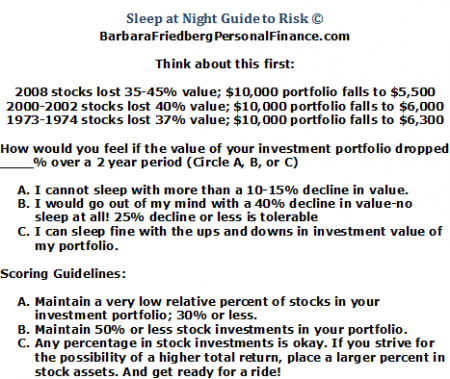

That said, my Sleep at Night Guide to Risk is a good place to start. The Quiz is listed below and on page 42 of Invest and Beat the Pros, Create and Manage a Successful Investment Portfolio. “How to figure out my risk tolerance” is an imprecise activity, but useful nevertheless when creating your investment portfolio.

This simple quiz gives you an idea of how much downward risk you can stand in your investment portfolio.

If you scored A, you are a very conservative investor, and should maintain a lower percentage of stocks in your investment portfolio.

If you scored B, there’s some leeway in your asset allocation and would be considered a moderate investor. You might be okay with 40% to 65% stock assets in your portfolio.

If you scored C, you’re a more aggressive investor and can allocate a larger percentage of your total portfolio into stock assets.

Stock Investing Warning

Before dropping a large amount of money into any asset, there are several factors to consider.

1. What is the economic climate and the overall valuation of the S & P 500 stock market index? After the recent seven year bull market in stocks, I would not suggest putting a large allocation into the stock market if you’re nearing retirement. It’s likely that within the next few years, we will experience a market correction.

2. Consider dollar cost averaging any large sums in order to avoid trying to time the market. That means invest regularly into your investment portfolio; weekly, monthly, quarterly, or semi annually. Dollar cost averaging yields more shares when prices are lower and fewer when they are higher. It’s a systematic way to tilt toward buying low. And, if you’re investing in your workplace 401(k), then you’re already dollar cost averaging.

Bonus read; Little Known Investing Secrets; How to Buy Low (Always)>>>

How to Figure Out My Diversification Strategy with an Asset Classes Portfolio

Now that you’ve answered the question, “How to figure out my risk tolerance” and have an idea of the percentages to direct into stock vs bond funds, you’re ready to set up your investment portfolio. Depending upon your risk tolerance, here are some sample portfolios to consider.

Each portfolio will be filled with low cost index funds according to the investor’s risk tolerance. The next article will provide a comprehensive list of various low cost index funds from a variety of issuers.

We’ll concentrate on simpler asset allocations with a maximum of four asset classes. If you are comfortable with more asset classes and willing to a bit more management, you can add more specialization as we did in the Aggressive Investment Portfolios.

Sample Diversification Strategy With Index Fund Portfolios:

Each of these sample portfolios include various categories of index funds. You can purchase these from a variety of providers such as Vanguard, Schwab, Fidelity, iShares and others. It’s your choice whether to choose fewer or greater number of funds in your portfolio. Part 4 of this series lists sample low fee index funds from which to choose.

Low Risk Tolerance-Conservative Investor

You are either a senior citizen or uncomfortable with the ups and downs in your financial portfolio.

Your portfolio will have more fixed assets (cash and bonds) and less stock investments than the more aggressive portfolios.

30% U.S. short-term bonds

30% TIPS fund

40% All world stock

30% Cash (CD’s, money market mutual funds)

30% I bonds

40% All world stock

70% Short term bond fund

20% Total U.S. stock market

10% All world (ex-US) stock

Bonus read; How to Rebalance Your Asset Allocation>>>

Medium Risk Tolerance-Moderate Investor

You can handle some volatility. You understand that your portfolio might go down 20 percent one year, but that over the long term it is likely to increase in value.

Your portfolio will have a moderate amount of stock investments and moderate amounts of fixed investments as well.

25% U.S. short-term bonds

25% TIPS fund

50% All world stock

20% Cash (CD’s, money market mutual funds)

30% I bonds

50% All world stock

45% Short term bond fund

25% Total U.S. stock market

20% All world (ex-US) stock

10% REIT

Hi Risk Investor-Aggressive Investor

You understand that in the long term stocks outperformed all other asset classes. You are confident that in the long term even the largest portfolio declines will be offset by increases in value, due to growing global companies.

Your portfolio will have more stock investments and fewer fixed investments.

30% Short term bond fund

35% Total U.S. stock market

25% All world (ex-US) stock

10% REIT

10% U.S. short-term bonds

10% TIPS fund

40% Total U.S. stock market

10% U.S. small cap stock

20% International stock

10% International REIT

15% U.S. short term bonds

15% I bonds

20% Total U.S. stock market

10% U.S. small cap stock

5% U.S. value stock

10% Developed market international (EAFE)

10% Emerging market international

10% U.S. REIT

5% International REIT

Coming next in Part 4: What are Index Funds and Asset Classes Investing? What Investments go into Asset Classes, you will get a list of low cost index funds from a variety of providers. We’ll discuss index funds in more detail.

Part 1: What is the best investing method?

Part 2; 8 Steps to Creating a Diversified Asset Classes Portfolio

Part 3: Diversification Strategy: How to Figure Out My Risk Tolerance (today)

Part 4: What are index funds and asset classes investing?

Part 5: How to buy low and sell high using a diversified index fund asset classes portfolio

Updated: January 23, 2017

Have you begun investing yet? What is your preferred asset classes allocation?