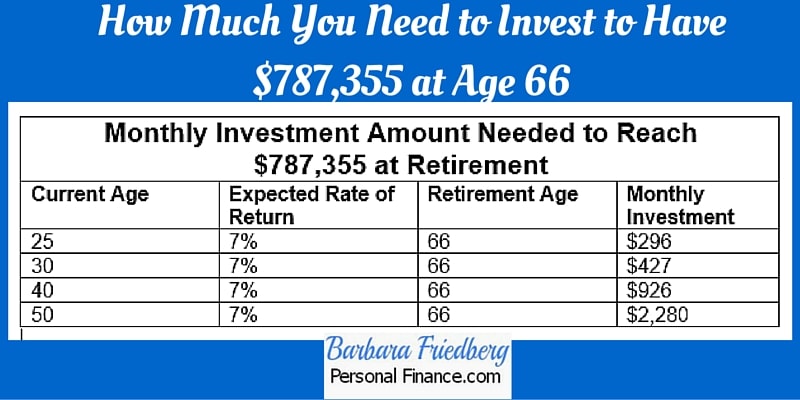

How to Save for Retirement at 30 and Become a Millionaire

7 Tips to Become a Millionaire “You only have to do a very few things right in your life so long as you don’t do too many things wrong.” ~Warren Buffett (source; BrainyQuote.com) Get the specific, actionable steps to become a millionaire if you are in your 30s. Use this financial advice for 30 somethings as a step-by-step guide for wealth building. If you haven’t started investing for your future, don’t stress, now is the time to start understanding and implementing how to plan for retirement…