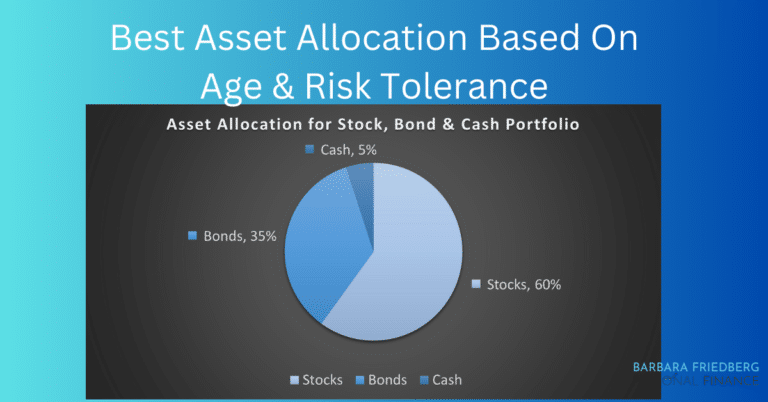

Best Asset Allocation Based On Age & Risk Tolerance

How To Figure Out the Best Asset Allocation For You Graham from Moneystepper asks; What metric (rule of thumb) would you recommend for asset allocation based on age and risk appetite? Choosing your best asset allocation is not as simple as it might seem. Let’s attack it from several investment angles and throw in a bit of research as well. What Is Asset Allocation?